You’ve served us—now it’s our turn to serve you.

You’re a hero. Whether you’re serving today, or served in the past, we’re offering FPU at half price to all service members. Get started today for just $39.99!

Sign in or create an account to get started.

82% of working-age veterans say they stress about money.*

You deserve a life where you . . .

FPU is the #1 personal finance class in America.

Over nine weeks, you’ll learn the fastest way to beat debt and build wealth—all with other people encouraging you (and even kicking your butt a little) along the way. It’s like boot camp for your money . . . without the push-ups. (You’re welcome.)

Sign in or create an account to get started.

In just nine lessons,

you’ll learn step by step how to:

you’ll learn step by step how to:

Create and live on a budget

Save for emergencies

Pay off debt fast

Invest wisely for the future

Take control of your money

April S.

“I always paid my bills, so I thought I was okay. But you’ve got to hate debt. It’s such a weight lifted. I feel like I broke a family curse, and now I have a legacy behind me.”

Val and Bryan T.

“I thought I was so strong and I could do this all on my own. And I was too ashamed and embarrassed. Be humble enough to put your pride down. Try something new.”

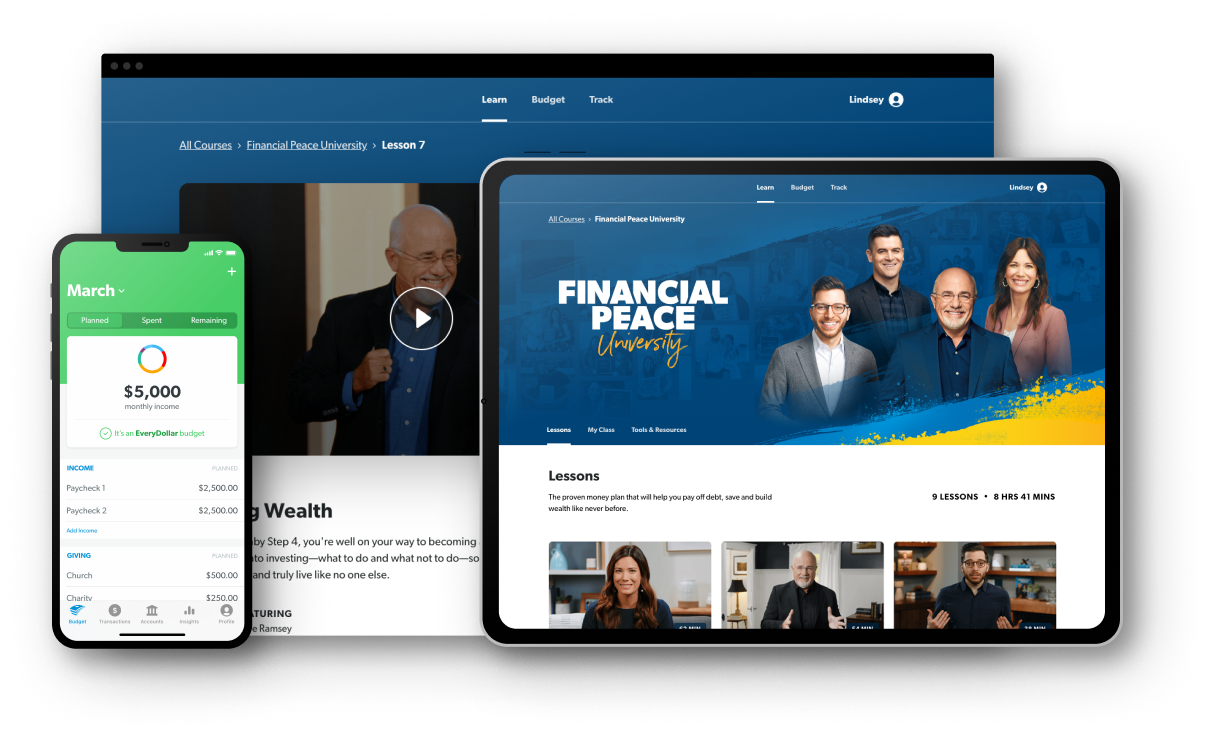

The nine-week FPU class experience comes with everything you need to succeed in the class (and long after).

• The in-person or virtual class of your choice

• Three months of premium access to EveryDollar

• Fully editable digital workbook

• One year of access to all nine video lessons

• A free one-on-one financial coaching session

• A year of unlimited group financial coaching

Sign in or create an account to get started.

*Blue Star Families, 2022

Common Questions (and Answers)

-

How does FPU work?

-

You’ll go through the class with a group of people either virtually or in person. Don’t worry—we’ll help you find the class that works best for you.

Once a week for nine weeks, you’ll watch a video lesson (each one is about an hour long) and then meet as a group for discussions and activities that drive each lesson home. (Aka, the most transformative part of FPU!)

And the results speak for themselves. FPU graduates pay off an average of $5,300 in debt and save an average of $2,700 in just 90 days. That’s a financial turnaround of $8,000—all for a few hours of your time over a few months. (Sounds like a no-brainer.)

-

Will this class work for me if . . . ?

-

It’s easy to feel like you’re the only one in your situation. But no matter where you are on your financial journey—sitting at rock bottom or just trying to do better—we’ve seen this class work for millions of people who:

- Have a huge amount of debt

- Have nothing saved for retirement

- Can’t get on the same page with their spouse about money

- Are facing a financial crisis

- Are newly widowed or divorced

- Are living paycheck to paycheck

- Have a low to average income

- Can’t keep up with their bills

In fact, the average FPU graduate is debt-free in two years or less!

Look, if you commit to FPU and don’t change your life, we don’t want your money. We’ll send it back to you—guaranteed.

-

Can my spouse come with me to the class?

-

We can’t say yes loud enough here. Getting on the same page with your spouse about money is crucial, and FPU has been a game changer for millions of couples.

Plus, it doesn’t cost extra for them to come—you’re both covered when you buy FPU.

-

Is Financial Peace University only for couples?

-

No way—FPU is for anyone! If you're married (or about to be), FPU is definitely one of the best ways to get on the same page with your spouse about money.

But if you're single, it can be tough to manage your money on your own. For better or worse, you have to answer to you. But in an FPU class, you'll get plugged into a community that will encourage you and hold you accountable—so you stay focused on your goals.

-

How long does the class last?

-

Financial Peace University has nine lessons. Most FPU classes meet once a week for nine weeks to go through one lesson each week. The sessions usually last one to two hours to give plenty of time for activities and discussions.

-

Will I get a workbook or other class materials?

-

Absolutely. Once you join a class, you’ll automatically get access to everything you need to go through the class—including a digital workbook. If you want a hard copy of the workbook (and we definitely recommend it), you can always order one.

-

Is there childcare available for classes?

-

Some classes offer childcare and others don’t. When you search for classes near you, you’ll be able to see the details of each class or reach out to the coordinator before you register.

-

Do I need to get my finances in better shape before taking FPU?

-

You know how the saying goes: “The best time to plant a tree was 20 years ago. The next best time is today.” The same goes for your money! Every day you wait to take control is another day you have to live with all this stress, fear and uncertainty about the future.

And we get it—you might be ashamed about some mistakes you’ve made with money. Or feel like you’ve wasted so much time. Or maybe you’re counting on a bigger income to fix the problem.

That’s okay! We’ve all been there!

In an FPU class, there’s no judgment. No shame. Just a bunch of people just like you all trying to figure this money stuff out together.

It doesn’t matter where you’re starting from. Just. Start.

-

What if I can’t find a class that works for me?

-

We’re not kidding—the hands-down, most effective way to change your situation with money is by taking this class with a group of other people. The accountability and support is that important!

But if you can’t find an in-person class in your area or a virtual class at a time that works for you, don’t let that stop you from taking control of your money! You can always go through Financial Peace University online at your own pace and join a class with others later.