Term vs. Whole Life Insurance: What’s the Difference?

9 Min Read | Dec 6, 2023

Listen to this article

Talking about life insurance is about as fun as unclogging your shower drain (and it’s not even your hair). But it really matters! If anyone in your life depends on your income, then you need life insurance. But not just any old life insurance—the right life insurance.

What Is the Difference Between Term vs. Whole Life Insurance?

Cost Comparison: Term vs. Whole Life Insurance

Don’t Wait Until You Need Life Insurance to Get It

Your two main options are term life and whole life. But which is better? Well, the first is a safe plan to protect your family, and—spoiler alert—the second is a rip-off. We’ll walk you through the big differences between these two plans, plus a few more important things to know. Check it out.

Key Takeaways

- There are two main life insurance options out there: term life insurance and whole life insurance.

- Term life insurance offers simple and affordable coverage for a specific amount of time, usually 10–30 years. If you die within the set term, your beneficiaries receive the policy’s payout. Simple as that.

- Whole life insurance has higher premiums because it combines insurance and investing—your money is paying for lifetime coverage and cash value options.

- If you pass away with a whole life policy, your beneficiaries receive the policy’s original payout amount. But if you don’t take out your cash value savings before you die, the insurance company keeps it.

What Is the Difference Between Term vs. Whole Life Insurance?

Here’s the difference in a nutshell: Term life has a set premium that stays the same throughout the life of the policy, and it only lasts for a defined number of years (aka a term). If you die during that term, your beneficiaries receive a payout.

On the other hand, whole life premiums can vary (a lot) over the life of your policy. And you’ll pay those premiums your whole life—even after you’re past the age when you’d need a death benefit for your dependents. Plus, whole life policies are overcomplicated (and overpriced) thanks to bad investment options on top of the life insurance portion of the policy.

We’ll give it to you straight—term life insurance works and whole life fails. The reason is simple: The true purpose of life insurance is to replace your income if you die, and to do it as cheaply as possible. And that’s exactly how term life works: It’s simple, affordable and reliable. But whole life? It tries to shove insurance and investing together, usually making an expensive mess.

Frankly, a life insurance policy isn’t a money-making scheme. We know you’re probably interested in building wealth and protecting your family along the way. And those are both legit goals! But each requires its own tool for the job, and you’ll see much better results if you keep them separate.

Bottom line: Don’t mix insurance with investing by purchasing a whole life policy. You’ve got way better ways to invest than what you’ll find in an insurance plan. Which sounds like more fun to you—investing in growth stock mutual funds so you can enjoy your retirement or “investing” in a plan that’s based on whether or not you kick the bucket? Easy answer!

Now let’s look closer at term life versus whole life.

Cost of Term Life vs. Whole Life

Monthly Cost by Age

| Term Life | Whole Life | Savings |

|---|---|---|

| $12.18 | $142.12 | $129.94 |

| Term Life | $12.18 |

| Whole Life | $142.12 |

| Savings | $129.94 |

What Is Term Life Insurance?

Term life insurance provides you with coverage for a specific amount of time (hence the word term). Let’s say you buy a $500,000 policy—we usually recommend getting 10–12 times your annual income in coverage—with a 20-year term. If you die at any point during those 20 years, your beneficiaries receive a life insurance payout of $500,000. Yes, it’s really that simple.

Compare Term Life Insurance Quotes

Term plans are also much more affordable than whole life insurance because term policies have no cash value unless you die within the set term. We’ll talk about that a bit more in the whole life section.

Term life policies have one straightforward job: to replace your income if you die. You pay a small monthly premium for what you need to provide for your loved ones if the unthinkable happens—nothing more, nothing less. Think of term life as the family guard dog—you hope you’ll never need him to do his thing, but you’re sure happy to have him around just in case.

Term Life Pros and Cons

Just to be crystal clear about why we recommend term life all day long, here’s a summary of the pros and cons. As you’ll see, term gets the job done better than whole life from just about every angle.

|

Pros |

Cons |

|

Is way more affordable than whole life. |

You’ll hear some smack about a lack of investment options, but this isn’t so much a con as it is a way to muddy the waters and sell you whole life. |

|

It gives you the option to invest however you prefer (instead of locking your cash into a very low-return investment). |

|

| It lets you move toward becoming self-insured (more on that below). |

Get Term Life Insurance Rates from Zander Today!

RamseyTrusted partner Zander Insurance will get you rates from top life insurance companies and pair you with the one that fits you best.

What Is Whole Life Insurance?

Whole life insurance (sometimes called permanent life insurance) is coverage that—you guessed it—lasts your whole life. Whole life plans are generally much more expensive than term life because you’re not just paying for insurance.

A whole life plan is designed to build cash value, which means it doubles up as an investment account and life insurance. Now, that might sound great at first. Two birds with one stone, right? It’s not. It’s overly complicated, costs you hundreds more per month, and the returns are often very low.

And with whole life, you have to make sure you cash out your investment savings before you die. Because if you don’t, your family won’t see it. Nope! It often goes right into the insurance company’s pockets. That doesn’t seem worth the hassle, does it?

Whole Life Cons and Pros

We don’t have a lot of positive things to say about whole life insurance. It’s one of the worst financial products on the market. But we’ll let this chart make that point for us.

|

Cons |

Pros |

|

Is far more expensive than term life. |

Here’s the only one we’ve discovered: Whole life is better than no life insurance at all! |

| It tries to do two financial jobs (insurance and investing) at once but doesn’t do either well. | Hunting for good things about whole life could become a new hobby? |

| It delays or stops you from ever becoming self-insured. | Trying to think of whole life benefits could help you build patience . . . |

| You (and your family) can lose a ton of your cash value if you die without cashing it out. | . . . still waiting . . . |

Here’s the moral of the story: Keep your insurance and your investments separate. You don’t want to spend years investing your hard-earned money only to leave it all to your insurance company. Be smart. Get term life insurance.

Interested in learning more about life insurance?

Sign up to receive helpful guidance and tools.

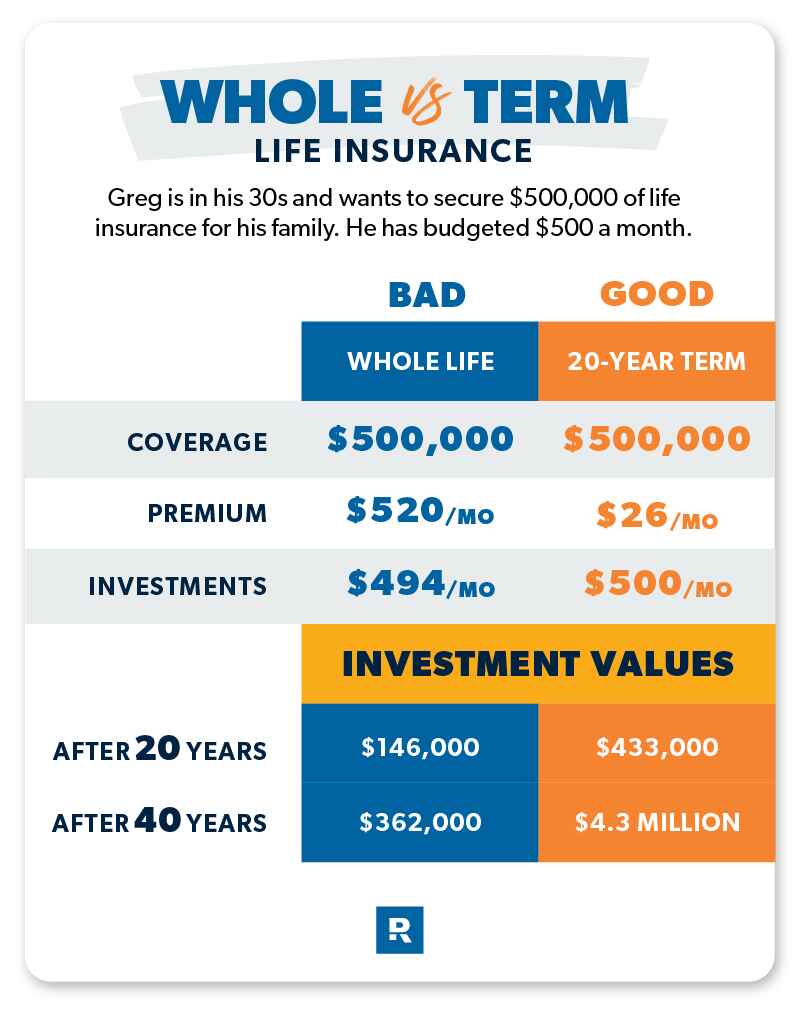

Meet Greg. He’s in his 30s and wants to get $500,000 of life insurance so his family will be okay if he unexpectedly passes away. A whole life agent pitches him a $520-per-month policy that’ll include the insurance coverage he wants and build up savings for retirement. On the other hand, a term life agent tells Greg he can get a simple 20-year term policy with $500,000 of coverage for about $26 per month—a near $500 difference.

Let’s say Greg goes with the whole life cash value option. He now has a hefty insurance premium to pay every month. But he’s okay with it because most of that money goes toward his cash value “investments,” right? Well . . .

In truth, the additional $494 per month disappears into commissions and expenses for the first three years. Then, the cash value portion will offer a horrifically low rate of return for his investments (we’re talking 1–2% here!).1

After paying way too much for 40 years, Greg’s 2% returns have built roughly $363,000 in cash value in addition to the $500,000 of insurance. Then, Greg dies. How much does the insurance company pay out to his family? $500,000. But wait! What happened to Greg’s $363,000?

You see, only Greg is entitled to that money. And Greg died before he had a chance to cash it out. So where do all his hard-earned savings go? The insurance company keeps the money.

Yep. Greg gets to roll over in his grave while his insurance agent enjoys five-star vacations on Greg’s dime. Sound like a scam? That’s because it is.

Here’s another truth about the difference between whole life and term life insurance. If you follow Ramsey’s 7 Baby Steps, you won’t need life insurance forever. Ultimately, you’ll be self-insured. Why? Because you’ll have zero debt, a full emergency fund, and a hefty amount of money in your investments to enjoy and leave behind for your loved ones.

So let’s go back in time. What if Greg chose the 20-year term life policy instead? He’d only pay $26 a month and could invest the money he saved by not choosing the whole life plan (roughly $500 per month).

If he invests in good growth stock mutual funds with an 11% average annual rate of return, he’ll have about $433,000 in investments by the time his 20-year term life policy expires and more than $4.3 million at age 70. That’s a lot of bang for his buck! We think Greg will rest much easier knowing his family will be staying at that five-star resort.

Monthly Estimate

0 - 0

Don’t Wait Until You Need Life Insurance to Get It

Look, this death stuff isn’t easy to think about. But the cost of not having a plan in place for the unthinkable is much higher than the cost of term life insurance. You need to keep the futures of your loved ones protected.

The ideal time to buy life insurance is when you’re young and have a clean bill of health, especially because life insurance companies look at the risks of the person purchasing the policy when underwriting it. And the older you are, the more risky (and expensive) you are to insure.

Next Steps

- Use our term life calculator to figure out exactly how much life insurance coverage you need. Remember, we recommend getting 10–12 times your annual income in coverage with a 20-year term.

- Connect with an agent from our RamseyTrusted partner Zander Insurance. They'll shop affordable rates from the top insurance companies and send you a list of custom quotes.

- Compare your quotes and pick the best term life policy for you.

Frequently Asked Questions

-

Is term life better than whole life?

-

Yes, it is far better to get term life than whole life. We don’t want you to get ripped off, we do want to see your family well protected, and we for sure want your financial future to include wealth and the chance to become self-insured. The only kind of policy that lets you hit all those goals is term life. But whole life misses the mark in every department.

-

How much life insurance do I need?

-

That’s easy. You need policy coverage equal to 10 to 12 times your annual income. Say you’re making $50,000 a year. You need at least $500,000 in coverage. That replaces your salary for your family if something happens to you. You can run the numbers with our term life calculator. Quick note: Don’t forget to get term life insurance for both spouses, even if one of you stays at home with the kids. Why? Because if the stay-at-home parent was gone, replacing that childcare and home upkeep would be expensive! If you want to make sure your family is covered, take our 5-Minute Coverage Checkup.

-

How long do I need term life insurance?

-

We recommend a policy with a term that will see you through until your kids are heading off to college and living on their own. That’s anywhere from 15 to 20 years depending on your kids’ ages. Why so long? Well, a lot of life can happen in 20 years.

Let’s say you get term life insurance in your early 30s, when you and your spouse have an adorable 2-year-old toddler. You’re laser-focused on paying off all your debt (including the house), but you have an eye on retirement planning in the future. Fast-forward 20 years—you’re both in your 50s and that little pint-sized toddler is now a college grad. The years went by fast.

But look where you are! You’re debt-free—and with your 401(k), savings and mutual funds, you’re sitting at a cool net worth of $500,000 to $1.5 million! By working the plan, you built up your net worth and your peace of mind. Now if the unthinkable should happen, even without life insurance, the surviving spouse could live off your savings and investments. Congratulations, you’ve become self-insured! Your need for life insurance has shrunk or vanished by now.

-

What happens to term life insurance at the end of the term?

-

It’s nothing sensational. The policy will just expire, but you won’t notice. You’ll already be in the money.

-

What information do I need when getting a life insurance policy?

-

Applying for life insurance will mean providing some personal info, so let’s look at a few of the things you’ll need to answer as you look for coverage.

- Do you already have any existing life insurance?

- How’s your overall health?

- Any medical history of serious illness?

- What’s your household income?

- How much are your monthly expenses?

- How much debt do you have, including a mortgage?

- What plans have you made toward retirement?

- What are your plans to cover college for your children?

- Have you thought about how you want to pay for funeral expenses?

- What’s your strategy around estate planning and tax?

- Do you have a will, and does it include plans for a trust?

- What’s your age?

- The ages of your children?