Let’s be honest here: Impulse buying is kind of fun—at least in the moment. You walk into Target for diapers, and before you know it . . . boom. Your cart is full of Chip and Joanna’s amazing throw pillows.

Oops.

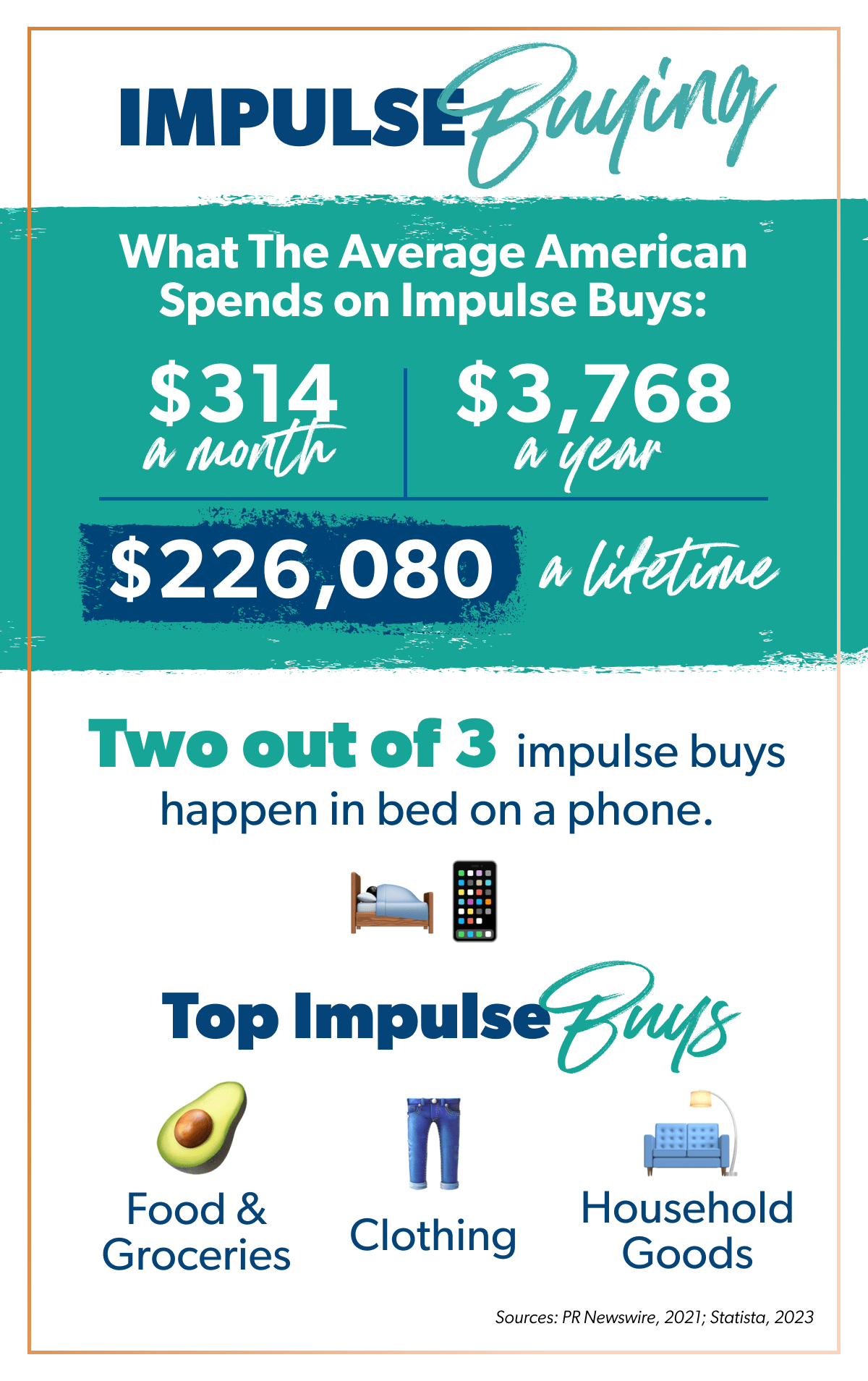

This is actually really normal. Americans impulsively spend an average of $314 every month.1 That adds up to an extra $3,768 spent every year and about $226,080 in a lifetime! Ouch!

I couldn’t help myself. I had to plug those numbers into our retirement calculator. And listen—if you invested that $314 every month for 10 years at an 11% average annual rate of return, you’d have over $68,000! Nothing like the magic of compound growth to put things into perspective.

What Is an Impulse Buy?

An impulse buy is any purchase you make when you weren’t planning to. If it’s not planned for in your budget ahead of time, it’s an impulse buy.

It can be as small as grabbing a candy bar in the checkout line (that wasn’t on your grocery list) or as big as walking into a car dealership “just to browse” and driving off in a brand-new SUV.

Examples of impulse buying:

- Candy, gum and energy drinks in the checkout line

- Clothing and shoes

- Video games

- Candles (Bath & Body Works is basically an entire store of impulse buys, am I right?)

- Home improvement purchases

- Toys (to keep the kids under control at the store)

- Extra cleaning supplies (just in case)

- Cars (yes, even cars!)

- Books

- “Treat yourself” buys

- Coffee and takeout

Almost all of us have fallen for the temporary excitement of impulse buying. In fact, a recent survey shows average impulse spending is up nearly 72% since 2020!2 And our own State of Personal Finance study reveals 45% of Americans say they struggle to avoid impulse buys.

Now, for any men reading this, I can see you nodding along, thinking, My wife does this all the time! But hold your horses. The top impulse purchases are clothing, household goods, and food and groceries.3 The last I checked, men buy those items too.

Why Do We Keep Impulse Buying?

Do you ever wonder how impulse buying gets you? There are four main reasons I see for why people impulse buy. They are:

- Our emotions

- Our past experiences

- A good deal

- The pure love of shopping

We impulse buy because of emotions.

Emotions play a huge part in what we buy. Our personal finances are just that—personal. So it makes sense that when something’s going on with us personally, it shows up in our money habits too.

When you’re having a rough day, does a little retail therapy sound like the cure? Maybe it’s nothing extreme. Maybe it’s just grabbing a new baseball cap or a new pair of earrings. You tell yourself it’s not a big deal—you just want to get something nice to make yourself feel better.

Hold up!

Making decisions based on pure emotion is a surefire way to let impulse buying take control. And sneaky marketers know this. They’ll play on your emotions with their ads, hoping it’ll hit a nerve that causes you to buy.

We impulse buy because of our past.

If impulse buying and overspending are problems for you, it could be that you were never taught how to handle money well.

Thinking about how money was handled in the household you grew up in will help you understand the foundation for your beliefs about money—aka your money mindset. If you’re married, this can also help you get to the root of money arguments you and your spouse may have. Their experience was probably totally different than yours, which means you guys are coming at this from two different perspectives.

Start budgeting with EveryDollar today!

If you want to do some more digging on how your past affects your spending today, check out my newest book, Know Yourself, Know Your Money.

We impulse buy when we believe it’s a deal.

I totally get this one because I love a good sale. I mean, who wants to pay full price? Or worse . . . for shipping and handling? Thank you, Amazon Prime, for making anything other than free two-day shipping feel like a crime.

But, you guys, this is a total marketing tactic. According to a survey, 64% of shoppers impulse buy because of a sale.4 When you think you’re getting a deal or “free shipping,” you’re way more likely to pull the trigger on the purchase—and that’s exactly what the marketers want you to do. I’m sorry, but it’s the truth. I’d bet Jeff Bezos’ fortune on it.

We impulse buy because we enjoy shopping.

Shopping really does make you feel better in the moment. When we shop, the body releases dopamine—that’s right, the brain’s happiness drug.

This love of shopping, in and of itself, isn’t a bad thing. What’s dangerous is when all that impulse buying adds up and your love of shopping turns into a shopping addiction. Your body starts relying on that dopamine hit, so you continue to feed it with more and more spending. But the point here is that it’s easy to like shopping on impulse—science says so.

How to Stop Impulse Buying

Okay, so how the heck do you keep impulse buying at bay? This is where I really want to help you, so get comfortable. Whether you’re on Baby Step 1 or Baby Step 7, I’ve come up with 14 tips to help you dodge the temptation to overspend.

1. Make a budget and stick to it.

First things first: You need a budget. If you don’t already have one, then stop right now and get started with our free budgeting app, EveryDollar.

And the kicker is, you have to actually stick to it! A budget isn’t a magic wand that will suddenly make all of your money behave. It’s on you to tell your money where to go each month and then follow through with that plan. If it’s not already budgeted for, don’t spend the money. Yep, it’s as simple and as hard as that. You can do this!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)

2. Give yourself permission to spend.

Yep, I just told you to stick to your budget—and you always should. But it’s also important to throw a little fun money in there too! Give yourself (and your spouse, if you’re married) a line item in the budget with your name on it for your fun spending.

Depending on your situation, this might be $10 a month or $100 a month. Just make sure the amount is reasonable and affordable for your budget.

The next time you’re walking through the mall and something catches your eye, you just have to check your fun money fund. Now you can shop guilt-free! You’ve already budgeted a small portion of spending money for it, so that reward or treat isn’t an impulse buy anymore.

3. Wait a day (or longer!) before you make a purchase.

Listen: Two-thirds of impulse shopping happens in our beds on our smartphones.5 It’s so easy to see something we want and click, click, click it into a purchase.

One way to help here is to give yourself a day or so to calm down when an impulse buy gets you jazzed. Once you have a cool head and a fresh perspective, ask yourself if you’ll actually use this thing and if you can pay cash for it now. That’s a no-nonsense way to look at the purchase and save yourself from tons of financial stress in the future.

And watch out for deals that are only good for 24 hours. Don’t let a countdown rush you into buying anything! Remember the offer, save some money, and be ready for it next time if you can’t afford it right now. Because a sale will come back around. Trust me.

4. Shop with a plan in mind.

Figuring out what items you want to buy and how much you’ll spend before you ever start shopping is one of my favorite ways to overcome impulse buying. With a plan in place, you’ll be less likely to give in to overspending. Your shopping list can range from grocery items to the Christmas gifts you plan to purchase for your extended family—just know what it is you want to buy before you go.

P.S. The best way to curb those grocery and takeout impulse buys is with a meal plan—and I’ve got a free meal planning and grocery guide that can save you from stress and overspending!

5. Beware of joining too many email lists.

Has anyone else’s inbox been absolutely flooded with sales lately? I mean, I’ve been doing great sticking to my budget, with everything planned and accounted for. But then, I check my inbox and find 15 different emails announcing one deal after another!

Now, I wasn’t even thinking about shopping—but then these marketers catch my attention, and I just have to see what’s on sale, right? Guys, we all could use a little “unsubscribe” in our lives.

6. Don’t shop when you’re emotional.

We just talked about this, but it’s worth mentioning again—don’t let your emotions control your spending habits! You might have a great day and make an impulse buy in the thrill of the moment. Or maybe you’re having a bad day, and you tell yourself you deserve something nice or that this item will make you feel better.

We’ve all been there before. It can happen pretty easily. So how can you fix it? Whether you’re celebrating or trying to cheer yourself up, don’t buy anything when your emotions are riding a roller coaster.

7. Bring someone with you when you shop.

Accountability goes a long way here. Do you have a sibling or friend who’s willing to get in your face and tell you not to buy something? Bring them on your shopping trip. Tell them what you plan to buy, and ask them to talk some sense into you if you start straying from the strategy.

8. Take only the amount of cash you’ll need.

Figure out how much money you need for the items you want to buy, and only take that amount in cash. You could even go a step further and leave your debit card at home so you don’t tempt yourself to buy more with plastic (even the debit card kind).

If you stick to your shopping plan and don’t bring any extra money along on the trip, you can’t make an impulse buy. It’s pretty much impossible. Now that’s the power of cash!

9. Stop the comparisons.

This is a game changer when it comes to impulse buying. If you always compare what you have (or don’t have) to others, you’ll never be satisfied. When we start comparing ourselves to other people, we’re playing a game we’ll never win.

Instead of looking at what someone else has and thinking, Oh, I need that too, take a step back and look at your life. Learn to be grateful for what you do have. If you change your perspective, you’ll find you already have a lot to be grateful for.

10. Get off social media.

It’s true—if you’re having trouble with comparisons, social media isn’t going to make it any better. If you know you have trouble being content when you scroll past everyone’s highlight reel, then remove the source of the problem. I’m not saying you have to kick social media to the curb forever, but try deleting Instagram and Facebook for a week (or more) and see if you notice a difference.

Even if you don’t find yourself falling into that comparison trap, the reality is that social media is one big billboard for impulse buying. Everywhere you scroll, someone is trying to get you to spend your money. But if you’re not on the app, you won’t see all the businesses with flashy sales and new products for you to spend your hard-earned dollars on.

11. Do a no-spend challenge.

Desperate times call for desperate measures, and sometimes a no-spend challenge is just what the doctor ordered. If you haven’t heard of this before, it’s pretty much just like it sounds—you don’t spend any money (on nonessential items).

You still pay for things like your rent or mortgage, regular bills, utilities, groceries, etc. But you don’t spend money on things like restaurants, the hair salon, new shoes or a new kitchen accessory. Basically, don’t even set foot in a store unless it’s to buy groceries (that are on your list!).

12. Forget your card number.

Okay, I admit it. I’ve memorized my debit card number. Real shocking for a spender, I know. I’ve done so much online shopping with this debit card that I actually have the number memorized.

If this is you, this seems perfectly efficient and you get me. If this sounds crazy to you, the rest of us are a little jealous that impulse buying is that much harder for you to do online. But does your card number autofill from your phone or web browser? Is your PayPal just one click away when you check out? If the answer is yes, you might want to consider erasing those numbers from your digital memory.

13. Ditch the credit card(s).

If you put those impulse buys on a credit card—and don’t pay off the balance—you end up paying even more than the average $314 a month I mentioned earlier. Why? Because you’ll have that average credit card interest rate too. Yup, you’ll have to pay 20.68% more on those things you didn’t plan to buy or probably even need.6

You guys, don’t let the temptation for rewards lure you in to using credit cards (that includes store cards too). They make it way too easy to turn today’s purchase into tomorrow’s problem—because you don’t see the cash leave your wallet or your checking account balance go down. It’s too simple when you don’t technically have to pay for it then and there, which is exactly how credit cards work.

Ditch the credit cards and the impulse buys.

14. Keep your goals in mind.

Here’s a real shocker: Giving in to an impulse buy won’t help you achieve your financial goals—whether that’s getting out of debt, paying off your mortgage, or investing for your future. Buying on impulse and overspending will eat up any extra money you were saving to put toward those awesome goals. So don’t shoot yourself in the foot here. Help yourself out by remembering the important goals you’re working toward!

Control Starts With Clarity

Spending money can be super fun, especially if you’re a spender, like me. But that excitement never lasts. If you want to learn more about your spending tendencies and take control of your money for good, I want you to do two things today.

First, get on that budget! Remember, EveryDollar is free, and it’s how you’ll stop wondering where your money went—and start telling it where to go.

Second, check out my newest book, Know Yourself, Know Your Money. You’ll see the way your past and personality affect how you handle your money—and learn how to start moving forward with your finances.

Listen, I want you to get the clarity you need to get unstuck with your finances. And you can! Take these two steps, and start being intentional—not impulsive—with your money.