Why You Shouldn’t Withdraw From Your Retirement to Pay Off Debt

10 Min Read | Nov 8, 2023

If you’re drowning in a sea of credit card bills, student loans and other debt, you might be tempted to do something desperate to cover your payments—including borrowing from your retirement.

But hold up! Raiding your retirement fund is a terrible idea that’ll only dig you into a deeper hole. Find out how withdrawing from your retirement early costs you in more ways than one.

Key Takeaways

- If you withdraw from your retirement early, you usually have to pay a 10% penalty, plus taxes on the money you take out.

- There are some exemptions to the early withdrawal penalty.

- Lying to get a 401(k) hardship withdrawal can result in fines, tax penalties, job loss and even jail time.

- The total cost of borrowing from your retirement to pay off debt is not worth it.

Should I Withdraw From My Retirement to Pay off Debt?

No, you shouldn’t pull money out of your 401(k) or IRA—even to pay off debt. Not only will you get hit with outrageous early withdrawal penalties and have to pay taxes on anything you take out, but you’re also stealing from your future self!

The only time you should even consider taking money out of your retirement accounts early is to avoid a bankruptcy or foreclosure. Otherwise, hands off the 401(k)!

When you do the math, you’ll see that you’re better off leaving your retirement investments alone and finding other ways to get rid of your debt.

Rules and Penalties for Early Retirement Withdrawal

Retirement investments like a 401(k) or an IRA (Individual Retirement Account) are great tools to build wealth and retire the way you want. But the key word here is retire. And tapping into those funds before it’s time to actually retire comes at a cost.

Here’s the deal: Any money you take out of a retirement account before you’re 59 ½ years old must be transferred to another retirement account within 60 days (this is called a nontaxable rollover). We repeat: 60 days! Otherwise, the money is considered to be cashed out, and the government will take its cut.

Exactly how much will you have to pay in early withdrawal penalties and taxes? Well, that depends on the type of retirement account you took money from: a 401(k), traditional IRA or Roth IRA.

401(k)

Withdrawing money from a 401(k) early comes with a 10% penalty. You also have to pay taxes on whatever you take out, but the IRS usually withholds 20% automatically. And if you take out a significant amount, it could bump you into a higher tax bracket.

So, if you took $20,000 from your 401(k) and that puts you in the 22% tax bracket, you may only get about $12,000–13,000 (depending on state income tax) when all is said and done.

Now, there are some exceptions to paying penalties on early 401(k) withdrawals (which we’ll dive into in a minute). But if you’re thinking about taking money out of your 401(k) to cover an expense or pay off debt, ask yourself this: Do I really want to borrow money at 30% interest? Of course not! And that’s basically what you’re doing when you dip into your 401(k) before retirement.

Traditional IRA

Whether you pronounce it eye-ruh or you sound out each letter, taking money out of a traditional IRA before you’re 59 ½ results in a 10% penalty. There’s no automatic withholding like there is with a 401(k), but you still have to pay federal and state income tax on the amount you take out.

Pay off debt fast and save more money with Financial Peace University.

There are also some exceptions to the early withdrawal penalty for traditional IRAs. But even if taking money out of your IRA seems like the easier option now, you’re going to regret it later.

Roth IRA

Since a Roth IRA uses after-tax dollars but grows tax-free (one of the reasons why we love it so much), you’re able to pull out any of your contributions, regardless of your age, without penalties or taxes. But if you want to take out any earnings (aka any growth from compound interest), you have to be at least 59 ½ and the Roth IRA itself has to be at least five years old. Otherwise, you must pay the 10% early withdrawal fee, plus any taxes.

But the whole point of investing in a Roth IRA is that you won’t have to pay taxes when you withdraw the money in retirement. You already paid taxes on the money you’re putting in there, so why would you want to pay more by taking your money out too soon? You should take full advantage of a Roth IRA—and the best way to do that is to leave it alone until you retire.

Exceptions to the Early Withdrawal Penalty

While you still have to pay taxes on any money taken out of a 401(k) or IRA before a certain age, there are some situations that let you get around the 10% early withdrawal penalty for retirement funds.

Exceptions for Both 401(k) and IRA

- You use the money to pay for medical expenses (as long as those expenses add up to more than 10% of your gross income).

- You had a child or adopted a child during the year (up to $5,000 is exempt for each account).

- You’re in the military and are called into active duty.

- The money is used to pay an IRS levy (a legal taking of property to pay back a tax debt).

- The money is divided into a series of substantially equal periodic payments (SEPP), also known as Rule 72(t). (This basically means you have to continually take out a certain amount from your retirement fund over time—and that’s determined by your account balance and life expectancy. Some people use this as a way to retire early.)

- You become permanently disabled.

- You die, allowing your beneficiaries to access your retirement funds.

Exceptions for 401(k) Only

- You leave your job the year you turn 55 or later (50 for certain federal and state jobs).

- The 401(k) is divided in a divorce under what’s known as a Qualified Domestic Relations Order.

- You overcontributed to your 401(k).

Exceptions for IRA Only

- The money is used for qualified higher education expenses (college tuition, room and board, books, etc.).

- The money is used toward the purchase or building of a first home (up to $10,000).

- The money is used to cover health insurance premiums if you’re unemployed.

Hardship Withdrawals

There’s also an exception to the early withdrawal penalty for a 401(k) called a hardship withdrawal. This lets you take money out of your 401(k) to meet an “immediate and heavy financial need,” according to the IRS.1

This could include repairing damage to your home after a natural disaster, covering funeral expenses for a loved one, or paying rent to avoid eviction. You’re only allowed to take out the exact amount needed for these expenses—and remember, you still have to pay taxes on it.

Right now, hardship withdrawals are on the rise.2 And unfortunately more and more people are lying about their situation to qualify for hardship withdrawal. But that, friends, is called fraud. Lying to get a 401(k) hardship withdrawal can mean fines, tax penalties, losing your job and even doing some jail time. In other words, be honest.

And even as it becomes easier to take money out of your 401(k), don’t forget you’re the one who has to live off that money when you retire. So be careful about what you call an emergency and hold onto as much of your 401(k) as you can for later.

The Danger of 401(k) Loans

Another mistake people make is taking out a 401(k) loan to pay off their debt. But with these loans, you’re technically borrowing from yourself and then having to pay yourself back—plus interest. No, thank you.

And 401(k) loans can backfire quickly. If you lose your job, the loan must be paid back within 60 days. If not, you’ll be forced to pay—you guessed it—the 10% penalty, plus taxes. But the truth is, you can’t borrow your way out of debt, so you should steer clear of loans altogether.

Why You Should Never Borrow From Your Retirement

Ever heard the old proverb, “Let the sleeping IRA lie?” No? Just us? The purpose of retirement funds is to make sure you’re taken care of once you stop working and the income is no longer rolling in.

But too many people treat their retirement fund as their emergency fund (spoiler alert: They’re not the same thing). And the more money you take out now, the less you’ll have for those beach-vacationing, golf-playing, grandkid-visiting days of retirement that you dream of.

When your 401(k) or IRA becomes an ATM, you lose out on all the money you would have earned with compound growth. Compound growth is your best friend—but only when you give it the opportunity to work. It’s not money for today; it’s money for tomorrow. Remember, investing is for the long haul, and it takes patience and self-control.

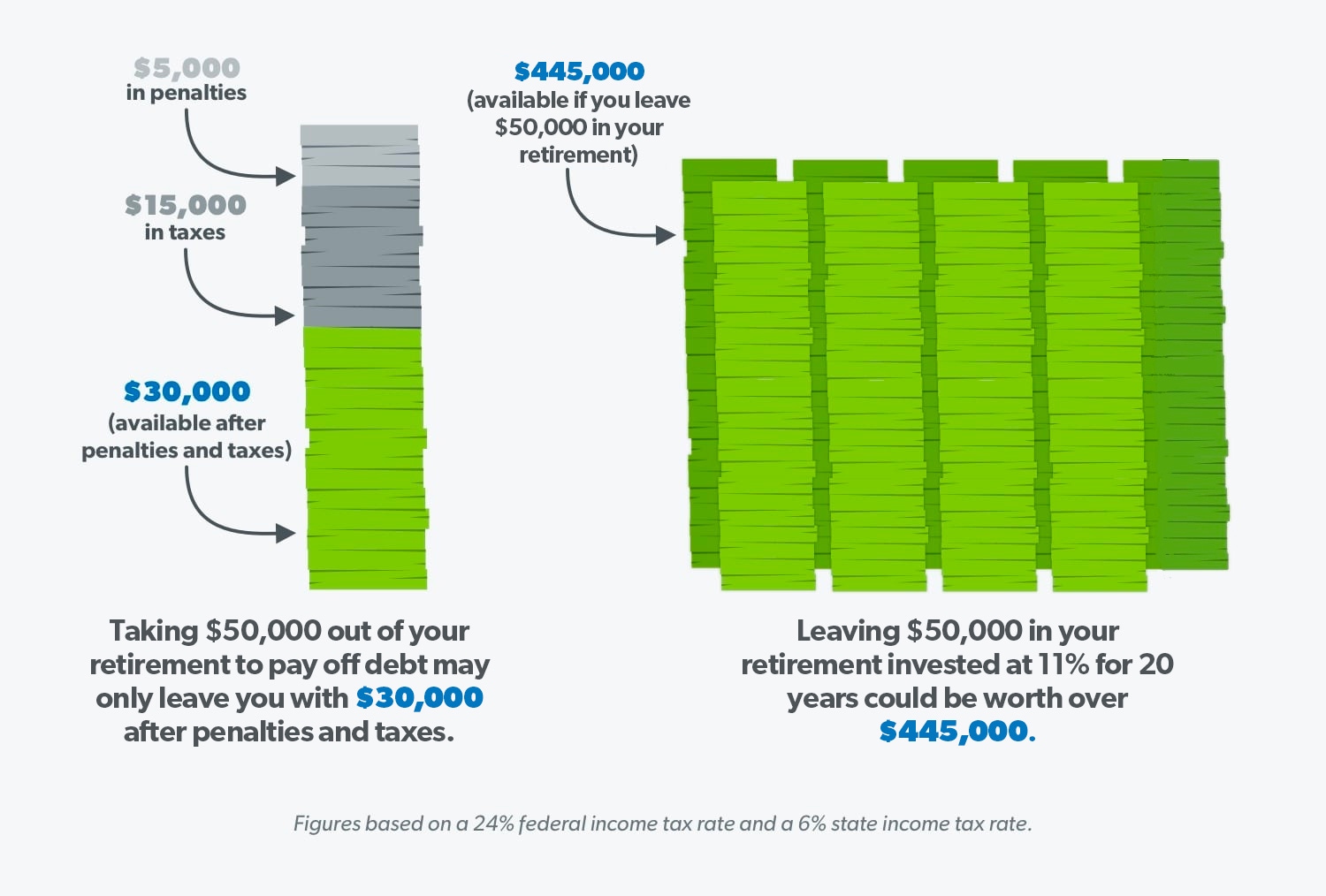

Let’s see how this plays out in real life: If you took $50,000 out of your IRA to pay off your student loan debt, you’ll end up paying about $5,000 in penalties and around another $15,000 in taxes—leaving you with only $30,000. That’s not okay! And the worst part is if you hadn’t touched your IRA and left that $50,000 invested for another 20 years, it could have grown to over $445,000! And that’s without you investing another dime. See? Leaving that money alone pays off big-time! Taking it out costs you even bigger.

Use our investment calculator to see what your investments might be worth when it’s time for you to retire.

Bottom line: The long-term cost of looting your retirement fund is simply not worth it. Many people say they can make up for the loss by putting more money toward retirement later, but there are limits to how much you can contribute each year—both for 401(k)s and IRAs.

The last thing you want is to have to work harder and longer because you didn’t save enough for retirement. Leave your retirement accounts alone, and when the time comes to use them you’ll be so glad you did!

How to Get Rid of Debt Without Ransacking Your Retirement

So, if you don’t cash out your retirement fund, how do you pay off your debt? We’re glad you asked! Here are some tried and true methods for paying off debt that your future self won’t regret.

Cash out your non-retirement investments.

Wait a minute. Didn’t we just say not to use your investments to pay off debt? Yes and no. We don’t want you to touch your retirement fund. But non-retirement investments are a whole different story. Things like certificates of deposit (CDs), savings bonds, single stocks, gold and crypto aren’t doing you any favors. Cash those babies in and use the payout to knock out some debt!

Get on a budget.

If you’re overwhelmed by debt, start with something simple—a budget. Having a written plan every month will help you get on top of your debt payments and actually make progress toward paying them off. In fact, budgeting is the best way to take control of your money—no matter how much you make. Download the EveryDollar budgeting app to create your free budget now.

Use the debt snowball method.

When you’re up to your ears in payments, you need a good game plan. The debt snowball method is the best (and fastest) way to pay off debt because it gives you the motivation and momentum you need to knock out multiple debts—one at a time! You can learn more about the debt snowball in Financial Peace University (FPU). This class will give you the plan, tools and community you need to get completely out of debt in two years or less.

Talk to a financial coach.

If you still feel like borrowing from your retirement fund is your only way out, you probably just need someone to walk you through all your options. That’s where a Ramsey Preferred Coach can help! They’ll answer your questions and help you make the best decision for your specific financial situation. Go ahead and talk with a coach for free.

Don't Go It Alone: Connect With a Financial Coach

A trained financial coach helps you navigate your money problems and make real money progress.