Tips for a Successful College Budget

9 Min Read | Feb 23, 2023

If you're in college, you're probably focused on so many things. You're trying to get good grades, set yourself up for career success, and win your intramural disc golf championship (hey, that's a big deal too). As you keep up with all of those important things, there’s another one I don’t want you to forget about: making good financial decisions.

Believe me, I get it—college isn’t easy. But being smart with money while you’re in school is just as important to your future success as your degree. And it all starts with a good college budget.

Why Do I Need a College Budget?

To put it simply: When you don’t have a budget, you’re not in control of your money. A budget is like a game plan, and when you don’t have a game plan, you’re more likely to lose the game. I want you to win with money.

You may not be completely on your own yet, but there are still several expenses you need to be prepared for as a college student. That’s where the budget comes into play.

Common Monthly Expenses for College Students

Here are some common monthly expenses that apply to most college students.

- Food: Whether you have a campus meal plan or you buy your own groceries, you’ll have to pay for your food.

- Textbooks: When most students see how much college textbooks can cost, their jaws almost hit the floor. But you can save money on textbooks if you know the right resources (and we’ll go over them later on).

- Transportation: Whether you have a car, ride the bus, or rent a campus scooter, you’ll be paying for transportation. (This can include routine maintenance, like oil changes and car insurance, in addition to gas.)

- Housing: Whether you live in a dorm or apartment, you’ll be paying rent.

- Entertainment: You want to have at least a little bit of fun in college, right? Entertainment expenses include everything from going to the movies with friends to taking flugelhorn lessons (if that happens to be the sort of thing you’re into).

It’s also important to think about saving money (a $500 emergency fund is a good place to start) and building the habit of generosity. Just because you don’t have a lot of money doesn’t mean you can’t think about helping others (I recommend giving 10% of your income).

And don’t forget about tuition. You might not be getting a monthly bill for it (most students pay their tuition before the semester begins), but that doesn’t mean you don’t need to think about it. You’ll want to save money for tuition every month—that’s one of the keys to avoiding student loans.

How to Make a College Budget

Now that you know why you need a college student budget, let’s talk about how to make one. If you’ve never made a budget, don’t worry. You can do this! And once we break it down, it won’t seem so overwhelming. Here are the steps to making your college budget:

1. Write down your income.

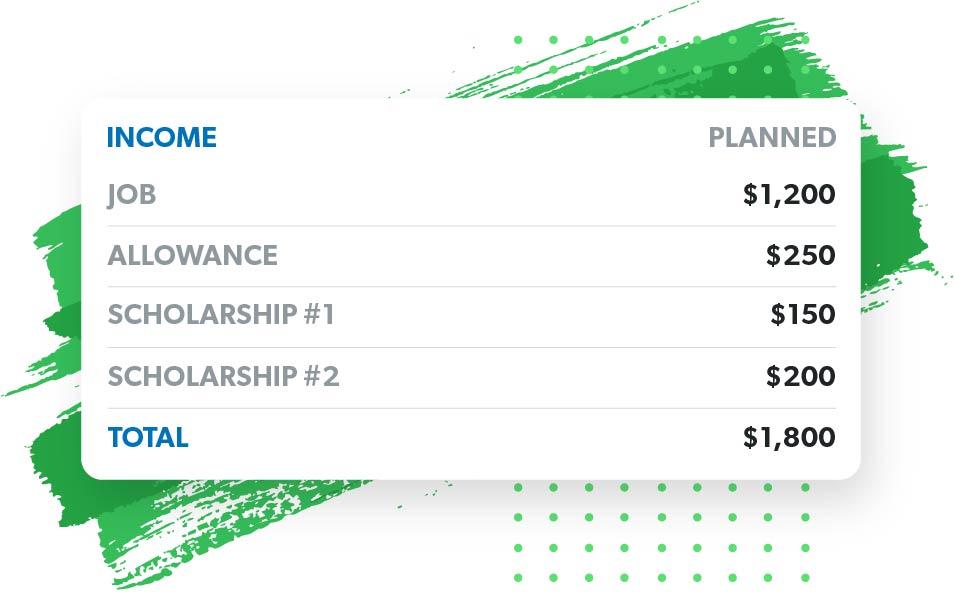

A budget is simply a plan for your money where you decide—before each month begins—how much you’re going to give, save and spend. So, the first step to making a budget is figuring out how much money you have to start with.

Add up how much money you’ll have coming in during the upcoming month from all sources—including the money you’ll make from jobs or side hustles, any scholarships that are paid to you directly, and any money you’ll receive from your parents (if they help you out in that way).

Start budgeting with EveryDollar today!

If your income varies and you can’t write down exact numbers, that’s okay—just get as close as possible. Once you’ve got all the numbers, write them down on your budget. Here’s what that could look like:

By the way, my favorite way to keep track of my budget is with the free EveryDollar app. It makes setting up your budget super easy—especially if it’s your first time. The best part? It does all the math for you. And did I mention it’s free to use?

2. List your expenses.

Next, you’ll want to write down everything you spend money on. The list I mentioned earlier is a great starting point, but you may have some other expenses that aren’t on the list. Look back at your bank statements or receipts and think about everything you spend money on—then write those things down in categories, like food, rent, bills, transportation and so on.

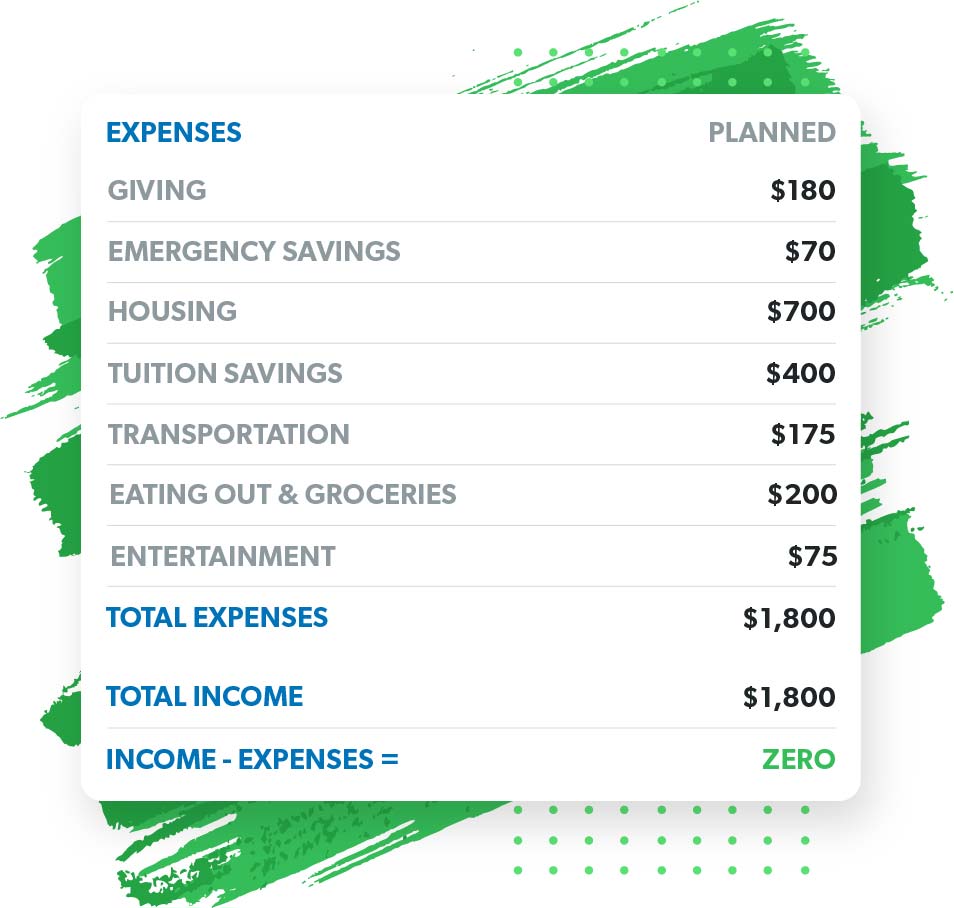

Once you’ve organized your spending into categories, plan how much you’ll spend on each of them. I like to start my budget with the right perspective by putting giving and saving at the top of my list. (Plus, this helps me make sure I don’t run out of money before I give and save.) Then I move on to the other categories.

Some expenses, like rent and subscription payments, are the same cost each month. For others, like food and transportation, you have more control over how much money you’ll spend. To make this easier, look at what you spent last month in each category.

3. Subtract your expenses from your income.

Once you’ve assigned a dollar amount to every category, it’s time for the fun part: getting out the calculator. Okay, maybe this isn’t super exciting (unless you’re a math major), but it’s also not that difficult.

Add up all the expenses you just listed, including what you plan to give, save and spend. Then, subtract that total from your income. The goal is for that to equal zero. Why? Because a zero-based budget, where your income minus your expenses equals zero, is the best type of budget. This means every single dollar you earn has a job. If you do the math and your difference is zero, you can go ahead and move on to the next step. If not, you’ll need to make some adjustments to get there.

So, if the total of your expenses is less than your income, give that leftover money something to do—maybe you add it to savings or give it to a cause you care about. And if the total is more than your income, you have two great options: increasing your income (trust me, there are plenty of ways to make extra money in college) or cutting back on your expenses. We’ll go over some tips on how to do that a little bit later.

Here’s what your budget might look like with the example income we used in the first step:

4. Track your spending.

Congratulations! You’ve made your first official college student budget. But you’re not quite done. Because you can’t just make a budget. You have to stick to it.

The biggest key to sticking to your budget is tracking your spending. If you’re looking for a simple way to track your spending without constantly combing through your bank account, EveryDollar is perfect for that. It’s free to make a budget on EveryDollar, but the premium version lets you connect your bank account so all of your transactions will automatically show up in the app. Super easy.

How to Cut Back on College Expenses

If you need some more room in your budget, cutting back on spending is an easy way to free up some cash. Here are some of my favorite tips for saving money in college and how students can spend less on monthly expenses.

How to Save Money on Tuition

There’s one tried and true way to cut back on tuition costs that every student should take full advantage of: scholarships. I talk to students about scholarships a lot, and I’ve found that many of them think you can’t get scholarships once you’ve started college. But that’s not true at all. There are plenty of scholarships for students already enrolled in college. My advice is to start researching scholarships you qualify for and apply to as many as you can.

How to Save Money on Food

A lot of colleges require meal plans, especially if you live on campus. If that’s your situation, try to get as much bang for your buck as you can. I know college food isn’t the best, and eating in the cafeteria isn’t as fun as making a run to Taco Bell or Chick-fil-A. But try to eat in the cafeteria as much as possible—you’re already paying for it, so you might as well get your money’s worth.

If you don’t have a meal plan, try buying groceries and eating at home more often instead of eating out. That’ll save you a ton of money in the long run.

How to Save Money on College Books

Shopping at your school’s online bookstore may be the easiest and most convenient way to buy books, but it’s rarely the cheapest. In fact, you can get used books for a lot less on sites like Chegg, eBay or Amazon. (Just make sure you purchase the correct version.) You can also save some money by renting books instead of buying them.

How to Save Money on Entertainment

There’s a good chance your college offers a lot of options for free entertainment. Try talking to older students and asking about some ways to have fun on campus without reaching into your wallet. Another great way to cut back on your entertainment budget is to limit the number of music and TV streaming services you pay for. There are several great free streaming services you can use. And be honest: Do you really need Netflix, Hulu, HBO Max and Disney+?

How to Save Money on Housing

Deciding on the best plan for college housing can be tricky. In some cases, taking advantage of on-campus housing is the most affordable option. Other times, finding a roommate and renting an apartment off campus is your best bet. Make sure you do your research and figure out which choice is the best for your situation.

By the way, if you do live on campus, becoming a resident assistant is a great way to save money on housing. RAs monitor the dorms and help with student activities, and in exchange, they typically get discounted housing and a cash stipend on top of that.

The Best Tool for Making Your Budget

Budgeting may not be the easiest thing in the world but, as you can see, you can do it. Plus, there are lots of great tools out there to make the process even more simple.

As I mentioned earlier, my favorite tool is EveryDollar. It was made by our awesome team at Ramsey, and it will let you set up your college budget in less than 10 minutes so you can get back to studying and playing guitar in the quad.