10 Car Buying Tips

Get Dave's practical car-buying tips before you head to the dealership. The key to happiness isn't a new car, so don't pay for it like it is!

Buying a car? Use our car payment calculator to see how much your monthly payment would be. Then stick around to see what’s even cooler than that car you’re eyeing (such a nail-biter, we know).

Buying a car? Use our car payment calculator to see how much your monthly payment would be. Then stick around to see what’s even cooler than that car you’re eyeing (such a nail-biter, we know).

Wait—before you buy a car, there's more you need to know. Download 5 Things Car Dealers Don’t Want You to Know to find out.

Wait—before you buy a car, there's more you need to know. Download 5 Things Car Dealers Don’t Want You to Know to find out.

Some of the terms on the car payment calculator are simple. And some of them are as confusing as why you would need scissors to open a package of scissors.

But don’t worry—it’s not just you. A lot of financial stuff can be confusing. And sometimes it feels like it’s designed to be that way. But around here? We’re not about that. We empower you to fully understand every decision you make with your money.

So, first things first. Before you plug in your numbers, let’s take a look at what all the terms in the car payment calculator mean.

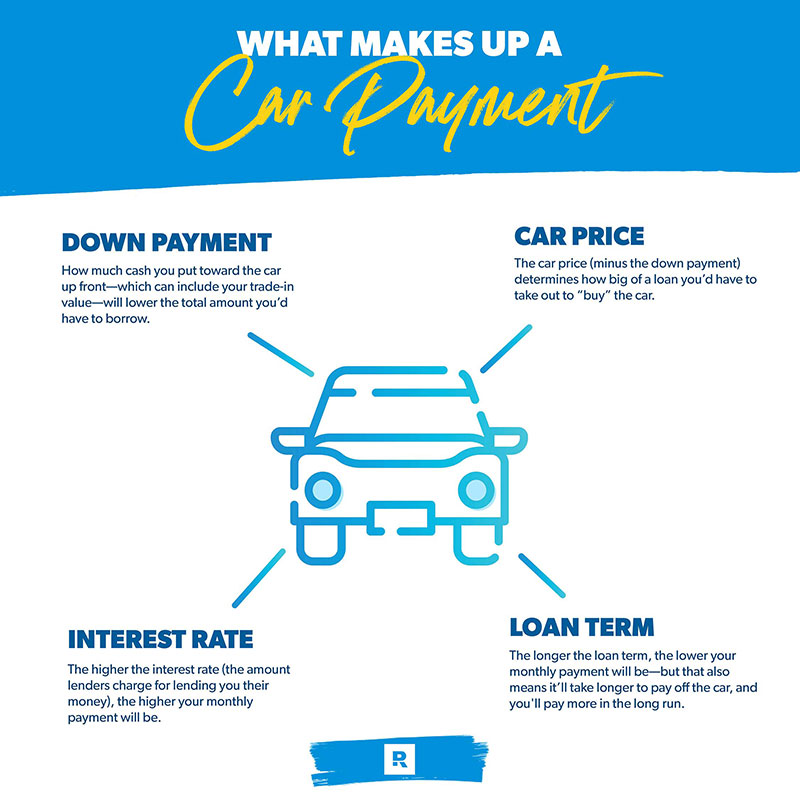

This one’s pretty simple. Car price refers to the amount of money you’re paying (or borrowing) for the car. Yep, that’s it. Just remember—whether you’re buying a car from a dealership or a private seller, the listed price is usually negotiable.

A down payment on a car works like a down payment on a home. The more you pay in cash up front, the lower your monthly payment will be. That’s because the down payment lowers how much money you’d have to borrow to “buy” the car. And then that lowers your monthly car payment.

But—spoiler alert—we go against the grain here. We say, why just have a lower monthly payment? Why not have no payment at all? Right, it sounds crazy. But it’s actually smart. Check out our stance on it below.

If you’re buying a car from a dealership, you might choose to trade in your car instead of selling it privately. (The one-sentence summary of that article? You typically make more money off the car when you sell it privately vs. trading it in.)

The dealership will decide how much they think your car is worth to them, and then they’ll take that much off the price of the car you’re buying. But remember, the dealership’s goal is to resell your trade-in at a higher price, so you may not get top dollar for it. This comes into play later. So, hang tight. (Or read ahead. We’re not writing a Sherlock Holmes novel here.)

Loan term refers to the length of time it will take to pay back the loan when you make regular payments. That means if your loan term is for 60 months and you never pay more than the minimum and you never miss a payment, then you’ll be done paying back that debt in 60 months, or five years (ouch). That also means you don’t technically own the car until it’s fully paid off—the bank (or whoever loaned you the money) does (ouch, again).

When you take out a car loan, that means someone lets you borrow the money you need to drive that car off the lot. You don’t think they’d do that for nothing, right?

That’s where interest comes in. The lender tacks on an amount of money to your monthly payment in exchange for lending you the money—and that’s how they make a profit.

Now that you understand what all these stuffy financial terms mean, it’s time to plug in your numbers to the calculator.

If you’ve already been car shopping and have all the info you need for the car payment calculator, this part will be a breeze. Enter what you’ve got. But if you’re still in the beginning stages, you can plug in what you think your numbers will be or use these average numbers as a starting point:

You’ll see three results:

What your monthly car payment would be:

Don’t forget—this is what you’d pay every single month for the entire loan term. And with the average new car payment at $576 for almost 70 months, that's that’s a really long time to pay on a car before you own it.2 Whew!

What you’d actually pay for the car:

Remember what we said about interest rates? This number represents the all-in price of the car because of them.

How much interest you’d pay during the term:

This shows you how much of your all-in price isn’t even going to the car. It’s money you’re paying the lender just for the “privilege” of borrowing their money.

If you want to play around with your results, just use the sliders to change the numbers. Adjust the slider on the car price to see how your monthly payment raises or lowers. Or you can adjust the slider on the results to see how the car price changes.

It may seem like the car loan is the superhero that lands you the car of your dreams, and that a monthly car payment is just the means to get there. But here’s another spoiler alert: It doesn’t have to be that way. You get to be the hero of this story.

The truth is, once you learn that car loans don’t exist for your benefit, you realize you can do something about it.

Auto loan debt in America is now sitting at a whopping $1.37 trillion, with 81% of all vehicles being financed.3,4

So, while yes, those numbers prove that financing a car is “a way of life” in America, let’s stop and think about that for a minute.

Why?

Do you really want another monthly payment added to your plate, or do you just feel like financing is the only way to “buy” a car?

Remember, the car dealership’s number one job is to convince you to finance a car (and most likely one that stretches your budget to its limit!). The truth is, dealers make more money when you finance, so they’re winning if they convince you to borrow more—whether that’s by extending your loan term, encouraging you to put down a smaller down payment, or selling you a pricier car if you have a larger down payment.

But what the car dealer won’t tell you is that your shiny new car will lose 60% of its value—what we call car depreciation—within the first five years!5

That means if you bought a car for $32,000, when you’re done paying it off (almost six years later), you’d have paid about $36,000 for a car that’s now worth maybe $13,000. And until you pay it off, you’re in an upside-down car situation. Yikes.

Plus, think about this—during your loan term, you’d still be paying the same monthly payment for a car that’s decreasing in value each month you pay. Let that sink in.

“It’s just $350 a month.”

“Everyone has a car payment.”

Sound familiar?

See, on the surface, $350 or even $500 a month seems innocent. But then, your dog needs surgery. Or your almost-teenager needs braces. Or—dang it—you just need more room in your monthly budget for life.

Where’s your margin? Oh yeah, it’s going to the bank for five more years.

On a practical level, your monthly car payment is costing you, well, money. And lots of it.

But even if you could squeeze out that monthly payment without too much stress, think about the extra you’re paying in interest. Thousands of dollars. And oh yeah—a new car with a loan will jack up your auto insurance. (That's even more money going down the drain.)

Instead, that money could be beefing up your savings account. Or you could even have enough to buy a reliable used car in straight-up cash. Then you could get the right auto insurance at the right price and keep your costs down.

Let's say you bought a used car with cash, and instead of wasting $500 a month on a car payment, you invested that money in a Roth IRA instead. After a 40-year period, that investment will be worth $4.3 million dollars.

So, back to our original question—how much is a car payment really costing you? More than 4 million dollars over the course of your life. That’s how much.

Research shows that the average monthly car payment for both used and new cars continues to rise each year—and the average monthly payment for a used car recently hit more than $400 a month for the first time ever.6

Maybe even more disturbing is that the amount of money Americans owe on their cars has increased by 95% since 2010, and 7 million borrowers are more than three months behind on their car payments!7,8

What does all of this actually mean? Americans are pushing the boundaries on their budgets, and in some cases, they’re pushing them past the limit.

But we don’t want that for you! So, when you’re deciding how much car you can afford, here’s our rule of thumb (we told you we go against the grain on this one). If you can’t pay for the car with cash on the spot, then you can’t afford it. Bottom line.

See, most people decide how much car they can afford based on how big of a monthly payment they think they can take on. But here’s our challenge. Instead of asking “How much monthly payment can I afford?” ask “How much car can I afford to pay in cash right now?”

That brings us to another question: How in the heck do you pay cash for a car?

We’re glad you asked.

Unlike popular belief, it is possible to buy a reliable used car with cash and not have a monthly payment strapping you down.

The first step is to buy a car you can afford with the cash you have in the bank—let’s say it’s $4,000. Next, take what you would’ve spent on a car payment—around $500—and put it in your savings account each month for a year.

By next year, you’d have $6,000 to put toward an upgraded car. Then, sell your current car, and now you have $10,000 for your next car!

And as one of our fave money experts, Rachel Cruze, points out, there are a ton of great cars out there for under $10,000, like these:

But here’s the best part—you don’t have to stop with an $8,000 or $10,000 used car. Take that same principle we just taught you, and do it again. Then, in another year, you’d have $6,000 more dollars to put toward another upgraded car!

Now, you have a paid-for car you love—and you still did it quicker than the average five-to-six-year loan term. Take that, car payment!

The truth is, this concept goes beyond freeing up your monthly budget. It frees up your life—and helps you have more money to put toward important things that matter to you, like saving more money or investing for retirement.

Remember, you’re the superhero here—not the car payment. Get that cape ready, Superman. You can do this!

But you don’t have to do it alone. If you want more guidance, we’ve got two amazing resources for you. First up, our Ramsey Car Guide will help you navigate everything you need to know about owning a car the smart way—from buying to selling to maintenance.

Next—if something in this article sparked an aha moment and you want to learn more about living debt-free, your next step is Financial Peace University (FPU). This course will show you how to budget, get out of debt, and save for emergencies—so you're more prepared for the future and ready to go after the life you want (without car payments holding you back).

While yes, millions of people are financing their cars, millions aren’t. There is a different way. Here’s Ali, who said no to car payments and yes to paying in full—in cash. She did it differently, and now? She gets to live differently. No payments. No weight. No stress. Just the minivan of her dreams!

“I never thought I would own a minivan and I never thought I would pay CASH for a minivan! Thanks to my bubs for teaching us the Ramsey way. But y’all, I love my van and I’m so thankful we started our debt-free journey last year! And Rachel Cruze isn’t kidding! When negotiating, GO SIT IN YOUR CAR! They came to my window and came down $1,500 off asking price! 😎 God is Good!”

“I never thought I would own a minivan and I never thought I would pay CASH for a minivan! Thanks to my bubs for teaching us the Ramsey way. But y’all, I love my van and I’m so thankful we started our debt-free journey last year! And Rachel Cruze isn’t kidding! When negotiating, GO SIT IN YOUR CAR! They came to my window and came down $1,500 off asking price! 😎 God is Good!”

Get Dave's practical car-buying tips before you head to the dealership. The key to happiness isn't a new car, so don't pay for it like it is!

Our cars help us get from point A to point B, but all that driving around comes at a cost. Here’s everything you need to know about car depreciation, why it matters, and how you can slow it down.

Whether you’re sick and tired of making monthly car payments or just want to upgrade your ride, here’s how you can sell your car and get a great deal in the process!