Turns out, there are a lot of budgeting apps out there. Why? Well, for one—people want a more convenient way to budget. An on-the-go app can make budgeting way easier to keep up with. It puts your budget right in your hands. Literally. And that’s great.

Another reason is that all these different apps offer slightly different things. They’re built on various money philosophies and have all kinds of features.

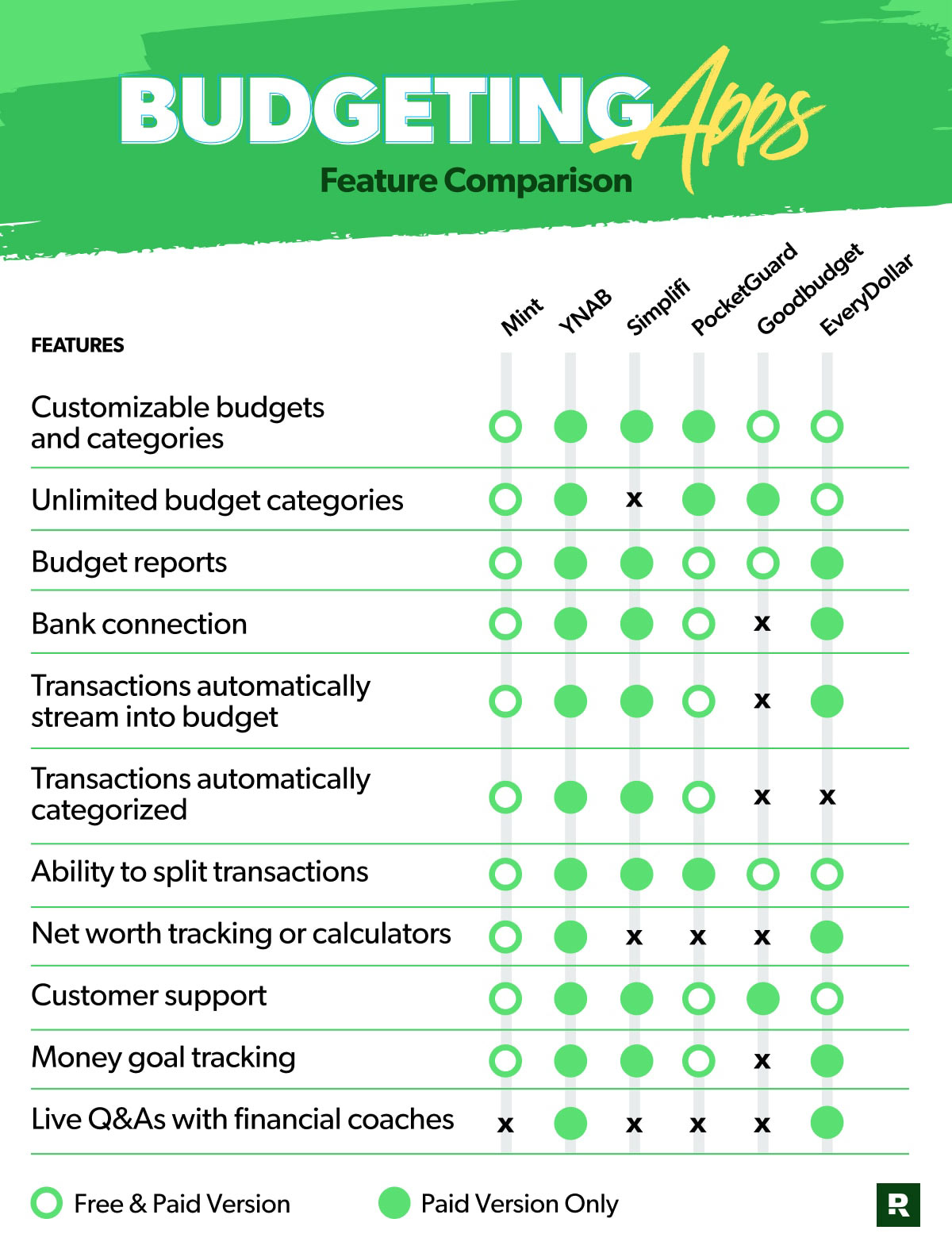

It can feel kind of overwhelming when you look at them all, so I wanted to compare six of the most popular budgeting apps out there right now. We’re talking cost comparisons, feature highlights, ratings from users, and some reviews from actual budgeters. Oh, and I’ve got a chart at the end of the article with all this information broken down to make it easy to see it all in one spot.

Alright. Let’s get started!

2023 Budgeting Apps

Mint

YNAB

Simplifi

Pocketguard

Goodbudget

EveryDollar

Budgeting Apps Comparison Chart

Mint

Mint announced that they'll be shutting down their budgeting app in March of 2024.

Mint Overview

Mint is one of the most popular budgeting apps today. They’re part of the Intuit family of products—meaning they’re related to TurboTax, QuickBooks, Credit Karma and Mailchimp.

Let’s talk about this budgeting app’s philosophy for a second. Mint automates a lot of the budgeting process and promotes the feeling of more hands-off budgeting—so budgeters engage less with their money overall.

Mint has a free version, or you can upgrade to their premium option for more features.

Cost

- Free for classic features (one person per account)

- $4.99 per month for Mint Premium

Free Features

- Customize budgets

- Get financial insights into your spending and saving

- Set due date notifications

- Connect to multiple financial accounts in one app

- Categorize your transactions automatically

- Have your transactions automatically categorized

- Track your net worth

- Check your credit score for free

Paid Features

- Get help canceling unwanted subscriptions

- Remove ads

- Compare your spending habits to other Mint budgeters

- Check out projected monthly spending

Ratings and Reviews of The Mint Budgeting App

4.8 App Store, 4.3 Google Play

First off, the net worth tracker looks like an awesome feature. And Mint users love that they can wrangle all their money management in one place. Getting your complete financial picture in one spot does sound great. I love when things are clear like that.

And you’d think having a budgeting app auto-populate your transactions into categories would be the best thing ever. It means you connect your bank to your budget, transactions come right in, and then Mint decides where those transactions should go. They do it all for you.

But here’s the deal: One of the biggest complaints reviewers point out is that Mint can often choose the wrong budget category. That makes sense, honestly, because you know when you stop by Target you can end up buying diapers for the Baby budget line, cardigans for your Clothing budget line, and orange juice for your Groceries budget line.

Mint doesn’t know, but they sort out all your transactions like they know. They might see Target and drop that transaction right into Groceries. Then you’ve got to go in and fix it after the fact. So, the effort to streamline your budgeting on the front end can make extra work on the back end.

Also, you guys, Mint can lead budgeters to be way too hands-off with their money. Yes, it’s nice to have some of the work done for you with budgeting—but being inside your budget is actually key to being in charge of your money.

You should actively tell your money where to go. Every month. Spending in and of itself isn’t wrong, but you should feel it. And putting your transactions where they belong helps you feel it and see what’s happening to your money. This is so important.

Also, Mint ads don’t have a budgeter’s best interests at heart. They promote credit cards, loans and other pro-debt products. Mint has no problem encouraging debt, and I just can’t get behind that.

I want you to be in control of your money. That means tracking your transactions yourself. That means owning your finances—not owing on debt. Even with the good stuff Mint offers, these things are deal breakers for me.

YNAB (You Need a Budget)

YNAB Overview

YNAB is a budgeting tool built on four rules. First, to prioritize and give your money jobs (aka the zero-based budgeting method). Second, to embrace your true expenses, which means you budget some money each month to break bigger, infrequent expenses up so you can pay cash when they’re due. Third, to roll with the punches, which means to adjust your budget and move money from one category to another if needed. Fourth, to “age your money,” which is where you save up a full month of income so you can pay this month’s bills with last month’s money.

Cost

- $14.99 per month

- $99 per year

Paid Features

- Connect your bank to your budget

- See budget reports

- Set and track goals

- Use the loan, spending and net worth calculators

- Split transactions

- Talk to a live person in customer support

- Join in live Q&A sessions

- Have your transactions categorized automatically

Ratings and Reviews of The YNAB Budgeting App

4.8 App Store, 4.7 Google Play

Though YNAB says they’re all about being less automated and more hands-on, they also auto-categorize your transactions. Yep. That’s the exact opposite of hands-on. One three-star rating I found pointed this out and complained that this feature makes the app difficult to use.

Again, you guys, an app doesn’t know when your Amazon purchase is seamless hair ties for your Fun Money line (yeah, that’s my new favorite purchase) or toilet paper for your Home Goods line. But you do.

Tell your money where to go, and watch where it’s going, okay?

As far as money philosophies go, YNAB built their app on some of the same principles we’ve been teaching at Ramsey Solutions for over 30 years, so you might see some similarities there. But they’re really into rolling over money in budget lines from month to month.

Now, this is different from a sinking fund, where you intentionally save up each month for a bigger purchase or an irregular expense. Sinking funds are super important. But if you have money left in a regular budget line, I don’t want you rolling it over to spend next month. I want you to put it toward your Baby Step. That’s how you’ll make real progress with your goals.

Also, YNAB budgeters weren’t happy about the price increasing from $5 a month or $50 a year to $14.99 a month or $99 a year. I know inflation is real thing right now, and costs are rising, but that’s a big jump and a big chunk of change those budgeters complained about having to free up to stay with YNAB.

Simplifi

Simplifi Overview

Quicken created Simplifi to offer a less hands-on budgeting tool that does most of the work for you. It sets up a budget automatically based on your previous spending habits and encourages budgeters to check in just five minutes a week.

Cost

- $5.99 per month

- $35.88 per year

Paid Features

- Connect to multiple financial accounts in one app

- Set and track goals

- See budget reports

- Get cash-flow projections

- Have your transactions automatically categorized

- Split transaction across different budget lines

- Get notifications of budget updates or reminders

Ratings and Reviews of The Simplifi Budgeting App

4.1 App Store, 2.5 Google Play

One of the biggest draws to Simplifi is how they can connect your budget to your bank account and loans—which should help you manage all your finances in one spot.

But one review says the app works better if you’re connected to just one bank. A few reviews say this complex feature seems to cause performance issues with the app. It can be slow and “buggy,” several reviews said.

But let’s talk about their encouragement to spend just five minutes a week with your budget. Listen, I know you’re busy. I’m right there with you. But you probably spend more than five minutes scrolling on social media, re-watching your favorite episodes of The Office, ordering coffee, and thinking about things that are honestly way less important in life than your money goals.

I encourage you to think about how you prioritize what you give your time to. I’m not saying you can’t watch TV or read a good book. Please do! But your future is too valuable to barely think about. Your finances are too important for just a passing glance. Be active with your money. Be in control!

PocketGuard

PocketGuard Overview

With a free and paid version to offer, PocketGuard’s main goal is to show budgeters how much money they have left to spend. They do this by featuring what’s “in my pocket,” aka how much you haven’t budgeted toward bills, goals or necessities.

PocketGuard is very hands-off, encouraging users to interact with the app pretty much only to see what’s left “in my pocket” to spend—to help prevent overspending.

Cost

- Free for classic features

- $7.99 per month for PocketGuard Plus

- $34.99 per year for PocketGuard Plus

- $79.99 for a lifetime purchase of PocketGuard Plus

Free Features

- Connect to multiple financial accounts in one app

- Have your transactions automatically categorized

- See your spending on a pie chart

- Get notifications when you’re close to overspending on a budget line

- Get third-party offers for other financial services

- Create savings goals (limited amount)

- Use pre-created budget categories

Paid Features

- Create custom budget categories

- Create unlimited budget categories

- Set up a personalized debt payoff plan

- Export transaction data

- Import transaction history

- Create unlimited savings goals

- Split transactions into different categories

Ratings and Reviews of The PocketGuard Budgeting App

4.7 App Store, 3.7 Google Play

Once again, an app automatically putting your transactions where it thinks they should go doesn’t work well. When your budget puts your spending in the wrong spot, you have to go in afterward and clean up the mess made by AI with good (but poorly directed) intentions.

I do appreciate that there’s a free version! That’s great to have options when you’re a budgeter. But why doesn’t the free version allow you to add in your own custom categories? That seems like a very basic ask for a basic budget. Also, as far as free vs. paid features go, several people complain about not being able to change the date on transactions that stream in unless you have the paid version.

Goodbudget

Goodbudget Overview

Goodbudget offers online and in-app budgeting based on the envelope system. Budgeters make digital envelopes for every budget category and can add in planned amounts.

Cost

- Free for standard version

- $8 per month for Goodbudget Plus

- $70 per year for Goodbudget Plus

Free Features

- Use up to 20 envelopes (categories)

- Have one account

- Access on two devices

- See one year of history

- Track debt

- Get in-app reports

Paid Features

- Use unlimited envelopes (categories)

- Have unlimited accounts

- Access on five devices

- See seven years of history

- Get email support

Ratings and Reviews of The Goodbudget Budgeting App

4.7 App Store, 4.3 Google Play

Okay, you know I love using the envelope method. I’m glad Goodbudget sees value in it too! But one review called Goodbudget “onerous” (which if you’re wondering, like I was, means involving lots of effort and being a burden—the more you know, right?). A few other reviews also call out the difficulty in setting up or using the app, with simpler vocabulary, thank goodness.

You guys, I don’t think setting up or using a budgeting app should be “onerous” or a burden. Effort? Some. Onerous? Never.

Also, several people complained about the limited amount of budget categories in the free version, and yes, there is a paywall that unlocks more categories, but again, unlimited categories is such a basic feature for a free budgeting app.

EveryDollar

EveryDollar Overview

EveryDollar uses the zero-based budgeting method, an approach where you give every dollar a purpose or job. (That’s where the app’s name came from!) This method brings accountability and helps budgeters keep up with their entire income by assigning all of it to giving, saving and spending.

Budgeters can use the free version of EveryDollar forever, test out the premium features of the tool in a free trial at any time, and upgrade for $79.99/year.

Cost

- Free for standard version

- $17.99 per month for the premium features

- $79.99 per year for the premium features

Free Features

- Customize budget categories and lines

- Create unlimited budget categories and lines

- Split transactions

- Set due dates

- Talk to a real, live person with customer support

- Set up sinking funds and track savings goals

Paid Features

- See custom budget reports

- Connect to multiple financial accounts in one app

- Set up and track money goals (vacations, emergency funds, mortgage payoff, retirement)

- Export transaction data

- Join in live Q&A sessions with professional financial coaches

- Stream your transactions automatically into your budget

- Get tracking recommendations for your transactions

- Set due date reminders for your bills

- See your current and projected net worth

- Plan your spending based on due dates and paychecks

Ratings and Reviews of The EveryDollar Budgeting App

4.7 App Store, 3.3 Google Play

Here are the things I love best about EveryDollar. One is how it’s set up to use the zero-based budgeting method. When you reach a zero-based budget, you see “It’s an EveryDollar budget” at the top of the app. If you’re off, it tells you what’s left to budget or how much you’re over. You can keep tweaking until you get to zero. That’s great guidance and affirmation while you’re budgeting. Love that.

Next, EveryDollar encourages you to interact with your money. With the free version, you manually enter all your transactions. You can also upgrade to the premium version and have your transactions stream into your budget—but they won’t auto-categorize.

It’s super simple to go in, see your transactions that have already shown up, and drag and drop them into the right spot. Then you see how much money you’ve got left in that budget line. Fantastic accountability, but also oh so simple. It’s the perfect balance.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)

One of the biggest complaints for EveryDollar is the cost of the premium version. If you know me well, you know I like spending money. I’m a natural spender. But I also love a good deal. So if I’m going to spend my money, I want to know it’s worth it. And you guys, first I want to remind you that the free version of EveryDollar is great. Really. If you want a free app for zero-based budgeting to help you stay in control of your money, use this version!

And if you want an upgraded experience, you need to take advantage of all the good stuff that comes with the paid version of EveryDollar. That’s what makes it worth the cost. There are the classic features, like the bank connectivity and transaction streaming, that are some of my personal favorites. You also can see custom budget reports right there in the app to compare how your budgeting habits line up to your money goals. It’s pretty eye-opening sometimes.

But there’s even more. Set reminders and have push notifications sent a few days before something is due. Jump in on live Q&As with professional financial coaches and others just like you. See your current and projected net worth. All inside your budgeting tool.

There’s even a new feature called financial roadmap that helps you set your big-picture goals and see the timeline of when you’ll reach each one—plus how a little extra work or savings can speed up your progress!

There’s also a feature called paycheck planning that helps you set up your budget based on when expenses are due and when you get paid—so you aren’t worried about running out of money between paychecks.

Yes, EveryDollar is the Ramsey Solutions budgeting app, so I’m going to sound a little biased. But that’s because it was built on all the principles we teach and gives you access to all the things we know will help you win with money!

I love EveryDollar because it lines up with what I teach about money, gives you options (free vs. paid with all those extras), and puts you in the driver’s seat with your whole financial future.

Budgeting is how you stay in control of your money. And that’s what I want for you. No more wondering where your money is going. Just a clear, intentional plan. That’s how you’ll go from where you are right now to where you want to be.

You can do this, you guys. Get started budgeting today!

Budgeting Apps Comparison Chart

Get—and Stay—in Control of Your Money

A budget is how you get there. And yeah, there are a lot of budgeting app options—but EveryDollar is our personal favorite.

Start EveryDollar for Free