Budgeting can feel like a lot at first. And on top of it all, there are so many different ways to budget. How do you pick?

Let’s dive into one popular method out there: the 50/30/20 rule. We’ll talk about what it means and how it works—and see if it’s the best way to budget for you.

What Is the 50/30/20 Rule?

What is the 50/30/20 rule? Well, this budgeting plan first showed up in 2005 in a book called All Your Worth. It was originally named the 50/20/30 rule—but you’ll see it called the 50/30/20 rule more often.

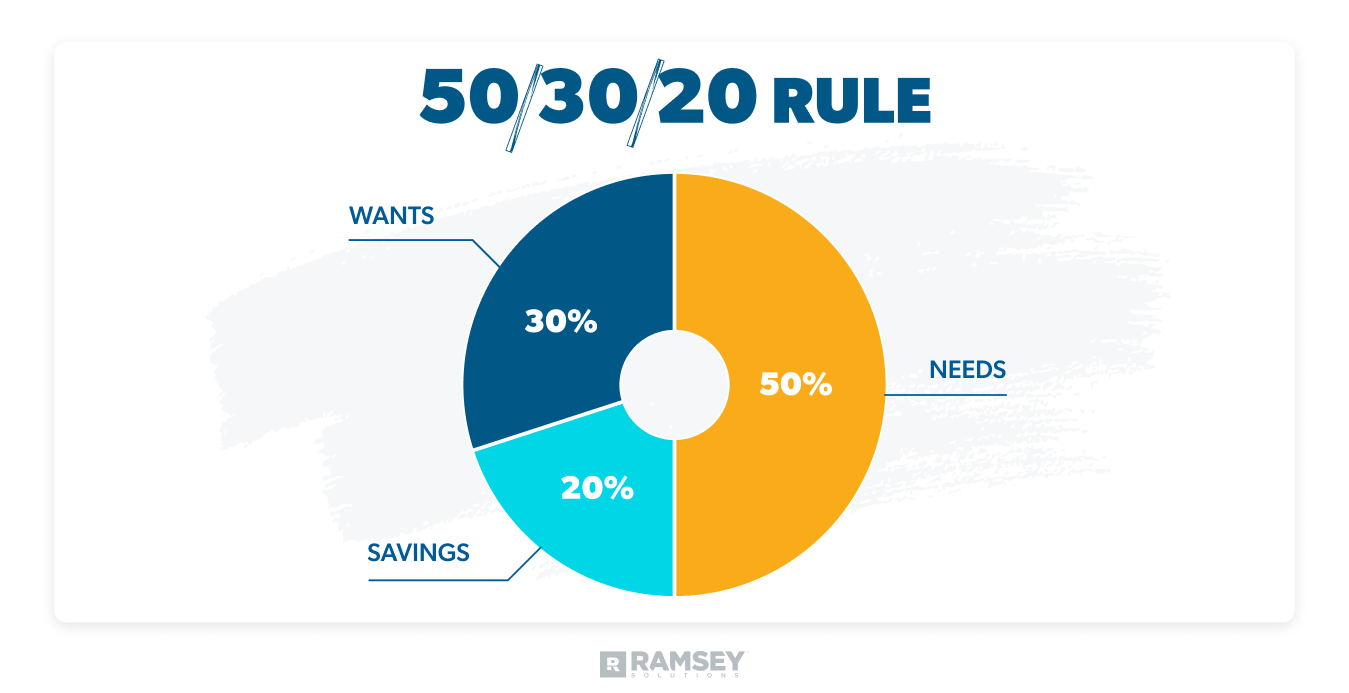

This budgeting method divides your spending and saving into three categories: needs (50%), wants (30%) and savings (20%).

50% Needs

Needs in your budget are all the things that would majorly affect your life if you dropped them. Here are some examples:

- Food

- Utilities (like electricity, water, natural gas)

- Shelter (aka mortgage or rent)

- Transportation

- Health insurance

- Day care

- The minimum payments on all your debts

If those things are in your budget, you need to pay for them—so they fall into this section.

30% Wants

You guys, read this carefully: Wants aren’t needs.

And we all know this—in theory. But when we start dividing things into monthly budget categories based on wants versus needs, the lines can get real fuzzy.

Wants still affect our lives, but not like needs. We can do without wants (even if it’s uncomfortable).

The 50/30/20 rule says to spend 30% of your take-home pay on the stuff that improves your standard of living. This includes things like:

- Unlimited data plans

- Restaurants

- New clothes (not because your kid outgrew his jacket but because you fell in love with a cute new jacket)

- Sporting events

- Concert tickets

- Streaming services

Hmm . . . so 30% of your income can go to the things you want, even if you’re drowning in debt or have an empty savings account? Something’s off here.

20% Savings

The savings category in the 50/30/20 rule covers some super important parts of your budget:

- Retirement investments

- Emergency fund savings

- Any extra debt payments above those minimum payments

That’s just 20% of your income to get you feeling safe and secure with money for today, tomorrow and down the line in retirement. And you’re working on all three at once.

Okay, so you can probably tell by now that I have some problems with the this rule. Let’s talk about why.

Pros and Cons of the 50/30/20 Rule

Pros

First, what’s helpful about the 50/30/20 rule?

Budgeting is a necessary habit.

On the upside, if you’re using the this rule to budget, well, you’re budgeting! You’re making a plan for your money, and that is so important.

Starting points are helpful.

Also, the 50/30/20 rule gives you a starting point to help you decide where your money goes. When you make your first budget, using an outline or guidelines can help you feel less overwhelmed. I totally get that.

You’re saving money.

Our State of Personal Finance study shows 34% of Americans have no savings at all. So I do appreciate that the 50/30/20 rule values building that up.

Cons

Ready to hear the problems?

It stays the same.

Those three budget percentages stay the same no matter where you are in life. Whether you have a mountain of student loan debt or you’re debt-free and investing in retirement, you’re stuck with 50/30/20.

Here’s the deal: You shouldn’t spend 30% of your money on wants if you’re in debt, because debt robs this month’s income to pay for last month (or last year, even). When you’ve got debt, you should cut down on extras so you can pay off the debt and get your income back in your control.

Start budgeting with EveryDollar today!

Also, the 50/30/20 rule has you plugging along slowly on the same goals all the time. You shouldn’t try to hit so many major money goals at once!

Instead, line up your big money goals (using the 7 Baby Steps to guide you) and knock them down one by one. You’ll be able to really focus as you save for emergencies, pay off debt, and build your retirement savings.

Guess what happens when you use your budget to take those steps one at a time instead of struggling to do it all at once, all the time? You. Make. Progress. And that’s what I want for you—to make progress with your finances!

Your budget should live and breathe with you. It should adapt to your stage of life and to your money goals. The 50/30/20 rule just doesn’t do that!

It’s way too focused on wants.

Focusing on your wants keeps you from ever getting ahead with your money. You might have to make sacrifices in your budget right now, and that’s okay. It’ll all be worth it later.

One day, if you follow the 7 Baby Steps I just mentioned, you end up being so financially secure that you can live and give like no one else.

Don’t box yourself into these three numbers forever. Do the hard work now so you can spend your money exactly how you want later.

Budgets aren’t one-size-fits-all. Your budget should reflect your reality. It should reflect where you are right now and where you want to be with your money—not be forced into some blanket percentage category. That’ll mean adjusting how much you spend on wants at different stages of life.

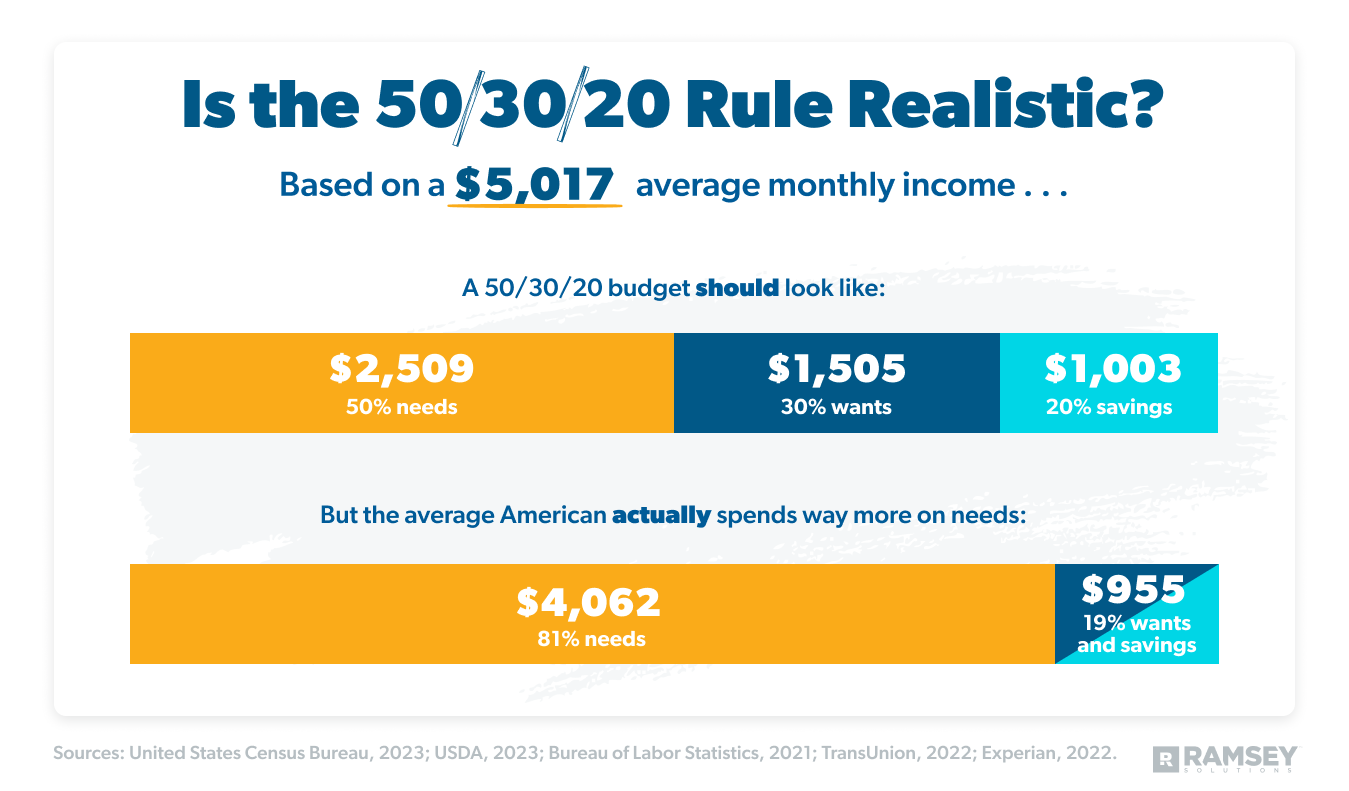

It literally doesn’t work for the average American.

Here’s the real kicker: If you plug in national averages for income and expenses, the 50/30/20 rule doesn’t work. Average needs are more than 50% of the average income.

Seriously. Look at this math.

First, Income

- $74,580 is the median household annual income.1

- $5,017 is roughly a household’s monthly take-home pay (after taxes, Social Security and Medicare come out).2

- Breaking that down with the 50/30/20 rule, you’d have $2,509 to spend on needs.

Next, Expenses

Let’s talk about common expenses that can count as needs and see if these averages add up to $2,509.

- Average monthly groceries for a couple: $6853

- Average monthly housing costs:

- Mortgage/rent: $1,885

- Electricity: $129

- Water: $58

- Natural gas: $37

- Household items: $584

- Average monthly transportation costs:

- Gasoline: $179

- Maintenance and repairs: $815

- Average monthly health insurance: $3096

- Average monthly credit card debt payment: $116.107

- Average used car payment: $5258

Total average expenses: $4,062.10

That’s not 50%. It’s 81%.

If you’re an average American with debt, you don’t have 30% left for fun or 20% for savings. You can’t use the 50/30/20 rule. And if you’ve been trying, you’re probably frustrated, and you might be sitting under growing credit card debt as you try to keep up with percentages that don’t work for your current life.

When you put the 50/30/20 rule to the test, well . . . that math doesn’t add up! Literally.

By the way, if this looks anything like your situation, I know those numbers are uncomfortable. Please know: You aren’t stuck here. It’ll take some work, but you can increase your income, pay off that debt, and get way more room in the budget.

But you’ll need a different kind of budgeting method.

The 50/30/20 Rule vs. the Zero-Based Budget

What you need is a zero-based budget. What’s that?

A zero-based budget happens when all your income minus all your expenses equals zero. You give every dollar a job and take control of every penny!

When you’re listing out your expenses, you start with giving and your needs. (What I call the Four Walls go first—food, utilities, shelter and transportation—and then other essentials come next.) After that, you prioritize everything else in the budget based on your income, your situation and your Baby Step.

As things change in your life, you change up where your money’s going!

And you do all this inside your flexible zero-based budget (which gets all your money working for you) instead of inside a no-budge 50/30/20 rule.

But first, you need a zero-based budgeting tool. And I happen to have one to recommend: EveryDollar. This is the budgeting app my family uses, and you can get started today. For. Free!

No 50/30/20 for you—no trying to cram your life and your goals into percentages that seriously don’t work. Go all in with the zero-based method and create a budget that’s literally made for you.