When you’re buying a home, it’s easy to feel overwhelmed by all the decisions you have to make. Are you looking for a fixer-upper or something move-in ready? City or country? Ranch house or townhome? Believe me, I get it. A home is one of the biggest purchases you’ll make in your life, and you want to feel confident making the right decision for you and your family.

I’ve got some good news: Your home can absolutely be a blessing! You just need to make sure you’re financially prepared to buy it, and that you buy a house you can afford. (Otherwise, this dream can turn into a financial nightmare.)

Here's the reality: Drowning in a house payment every month turns that blessing into a curse really quickly. That’s called being house poor, and it means you won’t have enough money left over every month for other financial goals, like investing for retirement or even saving for a vacation. Yikes.

Here’s some more good news: You don’t need a fancy degree in economics to avoid becoming house poor. You just need to know how to budget for a house, plain and simple.

How Do I Budget for a House?

We’re about to walk through the five key steps to budget for a house. But first, I need to warn you—you should only buy a house when you’re debt-free with a full emergency fund. Otherwise, owning a home and covering the expenses that go along with it will be super stressful. Without that kind of margin in your budget, anything that goes wrong or needs repair (like a broken fridge or leaky roof) can turn an inconvenient expense into a full-blown money crisis.So before you start making your house budget, pay off all your debt and save up an emergency fund worth 3–6 months of your typical expenses. Once you do that, these five steps will set you up with a great plan for buying a home on a budget.

With the right agent, taking on the housing market can be easy.

Buy or sell your home with an agent the Ramsey team trusts.

Step 1: Set Your Savings Goals

The first step to budgeting for a house is figuring out your savings goals. Here are three easy questions to get started.

- How much house can you afford? Take your monthly take-home pay and divide it by four. Ta-da! That’s how much of a monthly payment (including principal, interest, homeowners insurance, and HOA fees) you can afford on a house with a 15-year fixed-rate mortgage. (Anything more than 25%, and you run the risk of being house poor!) Our free mortgage calculator will give you a good look at the monthly payment you can expect for different home prices.

- How much of a down payment do you want to make? If you’re a first-time home buyer, you’ll want to save up a down payment of at least 5–10%. But if you can swing a 20% down payment, that’s even better—it’ll keep you from having to pay for private mortgage insurance (PMI), which can be pricey. Plus, a bigger down payment means smaller monthly payments on your mortgage. Who doesn’t love that? And don’t forget about extra money for closing costs and any other expenses that could pop up during the home-buying process.

- When do you want to buy a house? The way you set up your budget for buying a house will depend on when you’re planning to buy. For example, if you’re on the fast track to buy a house in 10 months, you’ll need to save more aggressively to reach your down payment. But if you don’t want to buy for a few years, you don't have to be quite as intense.

Next, it’s time to do some math (hooray!) to figure out how much money you’ll need to save each month to reach your goal. Divide the amount you plan to put down by the number of months you to save.

See how much house you can afford with our free mortgage calculator!

Let’s look at an example to see how this works. Let’s pretend a married couple who each makes a $50,000 salary have a combined monthly take-home pay of $6,250. They decide to get aggressive and save up a 28% down payment over the next two years so they can afford the monthly mortgage on a $200,000 house (with a 5% interest rate). Here’s what their savings goals would look like:

Now, you may be thinking $200,000 isn’t a whole lot to spend on a house. But here’s the deal: You may have to adjust your expectations when you’re buying your first home. House prices have gone up a ton in the last few years, so you’re probably not going to wind up with your dream home right out of the gate.

Don’t feel bad about buying a smaller, more affordable starter home if that’s what you can afford. And if you have to compromise on location, that’s okay too. Trust me: You’ll be so thankful you didn’t overspend on a house just because you wanted it to look and feel a certain way. Plus, you can always upgrade down the road when you can afford to!

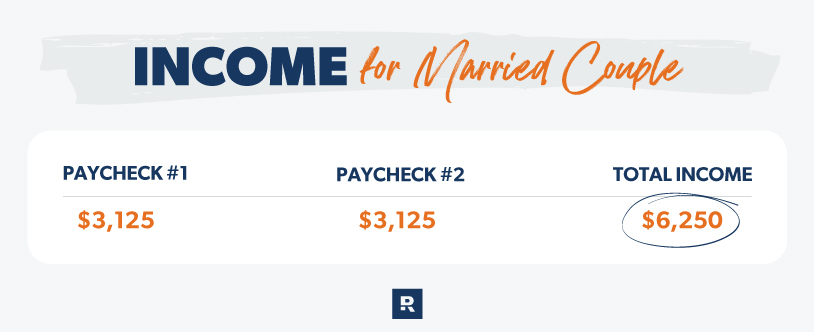

Step 2: Write Down Your Income

Once you’ve set your savings goals, the next step in budgeting for a house is writing down your income. After all, you can’t make a budget if you don’t know how much money you’ll have to spend!

So, sit down and add up every source of income you get each month. That includes your salary, any side hustles you have, and any other money you plan to make during the month. You want to account for every dollar you’ve got to work with.

Here’s what this step will look like for our example couple:

- Paycheck #1: $3,125

- Paycheck #2: $3,125

- Total Income: $6,250

Super easy, right?

Step 3: List Your Expenses

Now that you know how much money you’ve got coming in, it’s time to figure out where it’s all going to go by listing your typical monthly expenses. If you’re already living on a budget, then you’ve already completed this step! But if this is your first time making a budget, I promise it’s not as difficult as you think.

When it comes to the four expenses you'll cover first, start with food, transportation, housing and utilities—aka, the stuff we all have to pay for.

After you account for those four budget essentials, think about any other major categories you spend money on each month. This can include subscriptions, clothing, entertainment, routine car maintenance, eating out, and (most importantly) generosity. And since you’re saving for a house, one of the categories on your budget will need to be “house savings.”

Once you finish listing out the categories, you’ll need to figure out how much you’re going to spend on each of them. If you’re not sure how much money you should put toward a particular category, look at recent bank statements and receipts—that will give you a good idea of how much money you’ve been spending in each area. And don’t forget to plug the number you got from step one into your “house savings” category!

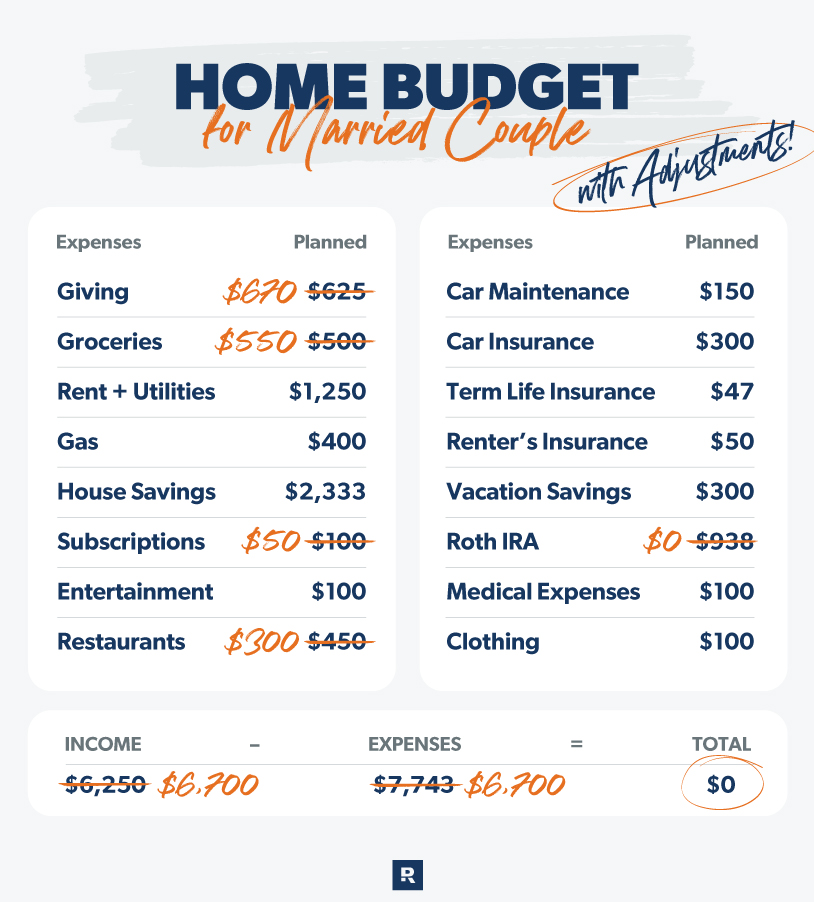

Let’s go back to our example of the married couple who each makes $50,000. Here’s what their home budget might look like after completing this step of the process.

As you probably noticed, they’re currently planning to spend more money than they actually make. We don’t want that! Luckily, the next step will help them (and you) get back on track.

Step 4: Make Adjustments

If this is your first budget, there’s a good chance you’ll wind up with more money going out than coming in when you list your expenses—just like the couple in our example. That means you need to do one of two things: increase your income or decrease your expenses.

But don’t worry! There are several ways you can spend less and make more, many of which aren’t even that difficult. To start, you can increase your income by getting a side hustle, asking for a raise, working overtime, selling items you don’t need, and plenty of other ways too.

When it comes to lowering your expenses, there are obviously lots of different things you can do. I cover several of the best ones in my free 14-Day Money Finder, where I’ll send you a practical tip on saving money every day for two weeks. But for now, here are three of my favorite ways to spend less while saving for a house:

- Temporarily stop investing. Consistently saving for retirement over time is a major key to a good financial game plan. However, if you want to pause investing while you focus on saving for a house, that’s A-OK. Just make sure you pause your investing for no more than three years (and go right back to investing 15% of your income every month as soon as you buy a house).

- Eat at home more often. You already know eating out is way more expensive than cooking at home. Now, there’s nothing wrong with eating out, but taking fewer trips to restaurants is a great way to save a whole lot of money (just make sure you add a little extra to your grocery budget).

- Limit your paid subscriptions. It feels like there are a million different streaming services to choose from these days. And even though most of them are less than $10 a month, they can add up quickly. So, if you’re looking for an easy way to cut down on expenses, canceling some subscriptions is a great way to do that. Not only are there lots of great free streaming services available, but chances are you don’t need Netflix, Hulu, HBO Max and Disney+.

Small changes like these can really add up, you guys. Don’t believe me? Let’s go back to our example couple.

Say the couple takes all three of those steps to cut back on expenses, and they each start a side hustle that earns $225 a month. Here’s what their updated budget would look like:

Pretty big difference, huh? With just a few small tweaks, this couple went from being nearly $1,500 underwater on their budget to having a zero-based budget that will let them make a 28% down payment on a new home in just two years.

Step 5: Track Your Progress

Okay guys, just one more step. Once you’ve made your home budget, you can’t stop there! For this whole thing to work, you’ve also got to stick to the budget and track your progress. That means you’ll need to review your transactions throughout each month to make sure you’re staying in line with the amounts you’ve set for each category of expenses.

My favorite way to do that is using the EveryDollar app. When you buy the premium version, you can link your bank account so the app will automatically download all of your transactions. It makes keeping up with everything super easy—no need to worry about old bank statements and receipts!

If you’re sticking to your budget every month, you should also be on track to hit the saving goals you set in step one. That means it won’t be long before you’re ready to buy a house. That’s so exciting!

Boost Your Buying Power

Now that you know the steps to budgeting for a house, it’s time to go out and get the best bang for your buck! To make that happen, you need an expert negotiator by your side. That’s exactly what a local RamseyTrusted buyers’ agents can be for you. They have your best interest in mind—it's why they’ve earned our stamp of approval. They can help you find a home that’s right for you and your budget.

Find a local RamseyTrusted agent in your area!

Next Steps

- Decide on your down payment amount.

- Divide that amount by how many months you plan to save.

- Set up a sinking fund on EveryDollar.

Frequently Asked Questions

-

Where should I stash my down payment?

-

You can stash your down payment in a simple money market account or high-yield savings account. You won’t make tons on interest, but you won’t lose money either. But guys, don’t forget that saving a down payment is not the same as investing for retirement—you want to keep your savings liquid and in a place that’s easy to access.

-

When should I start saving for a house?

-

As soon as you’re debt-free with a full emergency fund of 3–6 months of your typical expenses, you’re ready to start saving for a house!

-

How much money should you save before buying a house?

-

You should save enough money to make a down payment of at least 5–10% in addition to paying for closing costs and any other expenses that may pop up during the home-buying process. If you can put 20% down, that’s even better—it’ll keep you from having to pay for private mortgage insurance (PMI).